ETCO and FGV / IBRE: updated with data from the Continuous PNAD, Underground Economy Index confirms downward movement

Institutional improvement of the business environment and tax exemptions are pointed out, among other factors, as responsible for the continuous increase in formalization in the country.

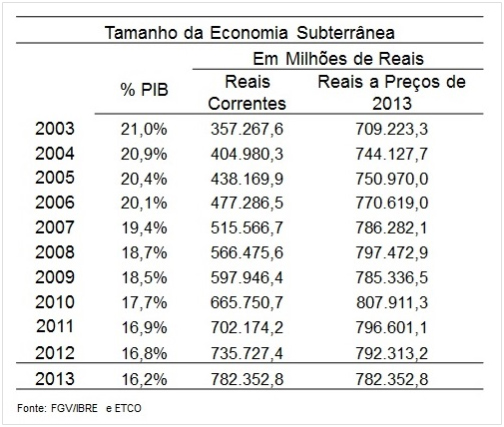

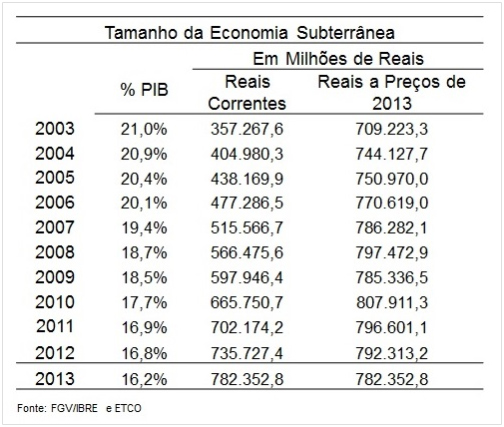

São Paulo, May 27, 2014 - The Underground Economy Index (IES), released today by the Brazilian Institute of Ethics in Competition (ETCO) in conjunction with the Brazilian Institute of Economics of the Getulio Vargas Foundation (FGV / IBRE), presented the brand 16,2%, which represents a reduction of 0,6 percentage point in relation to the previous year. This percentage results from the introduction of data from the new Continuous PNAD in the calculations used to obtain the estimate and also applied to correct the 2012 index.

In absolute values, the estimate is that the underground economy - the production of goods and services not reported to the government, which is outside the national GDP - exceeds the R $ 782 billion mark in 2013.

“The use of Continuous PNAD confirms the fall of the underground economy in the country, which we have been pointing out since the beginning of the historical series of the IES, in 2003”, comments the researcher from FGV / IBRE, Fernando de Holanda Barbosa Filho. This is because, according to him, the fall is even more relevant when the data from more than 5.000 small municipalities of the Continuous PNAD is incorporated, compared to the 3.500 of the previous PNAD. “Historically, formality is stronger in large centers, and this result shows that it is also spreading to small municipalities, even though the economy is no longer as vigorous. It is what I usually call the country's institutional improvement ”, explains Barbosa Filho.

Driven by access to credit, both for employers and for employees, who are forced to formalize their activities in order to obtain financing, the drop in informality may also be rooted in tax breaks for some sectors of the economy.

“As well as the tax exemption, other factors, such as the expansion of the use of the Electronic Invoice, the reduction of tax bureaucracy and policies aimed at small business owners (MEI, Simples Nacional), show the importance of public policies to contain informality” , says ETCO's executive president, Evandro Guimarães. For him, "measures like these certainly have a lot of value in balancing the economy, and should always be analyzed from the perspective of reflexes in the short, medium and long term".

What is certain is that informality brings direct damage to society, creates an environment of transgression, stimulates opportunistic economic behavior, with a drop in the quality of investment and a reduction in the growth potential of the Brazilian economy. In addition, it causes a reduction in government resources for social programs and investments in infrastructure.

About the Shadow Economy Index

ETCO believes that knowing the size of the problem is critical to tackling it. Much is said, but little is known, about informality, piracy and evasion, as, as illegal activities, they are difficult to measure. The ETCO, in conjunction with the Brazilian Institute of Economics of the Getúlio Vargas Foundation (FGV / IBRE), has been publishing since 2007 the Underground Economy Index, a study that estimates the values of activities deliberately not declared to public authorities, with the objective of evading taxes, and those of those who find themselves in the informal sector due to excessive taxation and bureaucracy.