Underground Economy Index remains in decline, point ETCO and IBRE / FGV

Impacted by the acceleration of formalization indicated by the Monthly Employment Survey (PME), an estimated index for 2013 is 15,9% of GDP

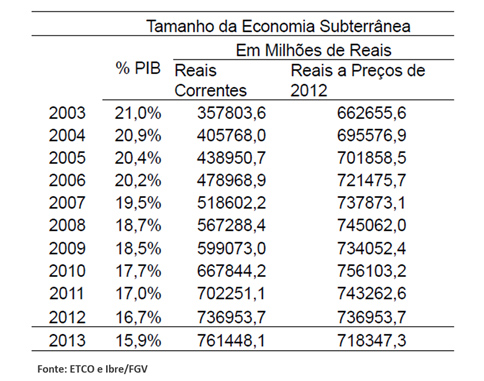

The Underground Economy Index (IES) released at the end of November by ETCO, together with the Brazilian Institute of Economics of the Getulio Vargas Foundation (IBRE / FGV), reached the 15,9% mark in 2013, which represents a reduction of 0,8 percentage point in relation to the previous year.

The Underground Economy Index (IES) released at the end of November by ETCO, together with the Brazilian Institute of Economics of the Getulio Vargas Foundation (IBRE / FGV), reached the 15,9% mark in 2013, which represents a reduction of 0,8 percentage point in relation to the previous year.

This means that, in absolute values, the estimate is that the underground economy - the production of goods and services not reported to the government, which is outside the national GDP - exceeds the R $ 760 billion mark in 2013.

“The process of formalizing employment in the country is here to stay. Factors such as the ever smaller demographic growth, with the consequent reduction of people in the labor market, influence the fall in unemployment and a low unemployment rate favors the reduction of informality ”, comments IBRE / FGV researcher Fernando de Holanda Barbosa Filho . He recalls the influence of the increase in the general level of education of Brazilians in the fall of informality. “Between 2001 and 2011 there was an increase of 22 million people with formal education”, says Barbosa Filho.

Despite the positive reading, it is necessary to consider that the unexpected acceleration of the drop in informality may be rooted in other specific factors, which should not be neglected, such as the temporary payroll exemption for some sectors of the economy. “The exemption from payroll, in theory, should have an impact on informality, but there is no way to affirm or make an analysis of the direct impact of the measure on informality, yet”, says the researcher.

For the Executive President of ETCO, Roberto Abdenur, "the current results reflect the desired structural changes in society, such as, for example, the increase in the educational level and the low unemployment rate, which is extremely positive for the country".

With regard to payroll relief measures, he highlights the government's effort to create incentive mechanisms for certain sectors of the economy. “We just cannot lose sight of the possible impact of this tax waiver on tax revenues and, consequently, on the provision of public services”, he evaluates. In 2012, the tax waiver was of the order of R $ 4 billion. For 2013, it is estimated to reach R $ 18 billion, while for 2014 the perspective is R $ 34 billion.

“Measures like this certainly have a lot of value in balancing the economy, but they should always be analyzed from the perspective of reflexes in the short, medium and long term. It is necessary to look at tax reform more broadly, so that it allows a more lasting and horizontal exemption ”, says Abdenur, recalling the need for other measures, such as the control of public spending.

For ETCO, informality brings direct damage to society, creates an environment of transgression and encourages opportunistic economic behavior, with a drop in investment quality and a reduction in the growth potential of the Brazilian economy. In addition, it causes a reduction in government resources for social programs and investments in infrastructure.