Simplification of the tax system and law against unfair competition are discussed by experts

A meeting held by ETCO, in the last week of July, brought together representatives of the institute and the specialized press on the theme “Taxation and Business: Obstacle or Instrument for Development”. With the presence of tax attorneys Everardo Maciel and Hamilton Dias de Souza and the chief executive of ETCO, Roberto Abdenur, issues such as simplification of the tax system and regulation of article 146-A of the Constitution were discussed.

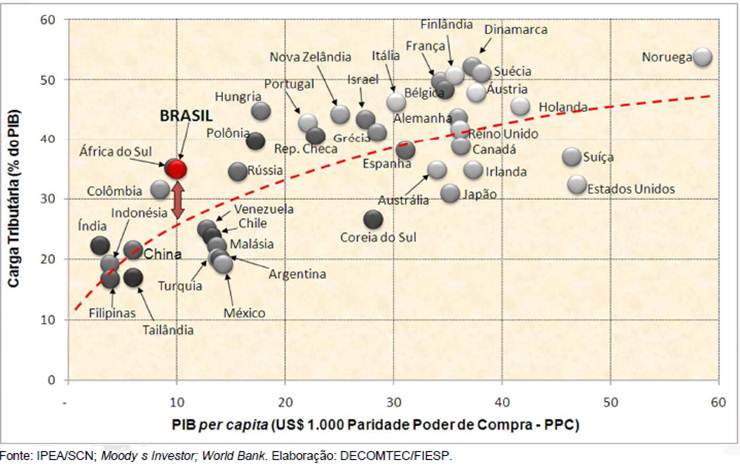

Currently, the incidence of taxes accounts for 36% of the Brazilian Gross Domestic Product (GDP). This data alone should not cause so much concern, since, as is known, countries with a high level of development present even higher burdens. The issue becomes worrying when the tax burden is compared with the GDP per capita of these countries.

The chief executive of ETCO, Roberto Abdenur, explains that "despite being vital for the country, the current tax system is considered as one of the main obstacles to economic development". Abdenur also highlights as one of the main impacts caused by the high tax burden on the economy, the increase in the cost of production in the industry, which discourages investments.

Data from the Federation of Industries of the State of São Paulo (Fiesp) show that, in Brazil, 64% of entrepreneurs point to the tax burden as a limitation of investments and 59% of them point to it as the main obstacle to innovation. The situation is even worse when this same load is assessed with the Human Development Index (HDI).

“While the Brazilian tax burden increased by 24,4% between 1994 and 2007, the HDI grew only 10,7%, which proves that the increase in taxes is not favoring the development of the population”, explains Abdenur.

Abdenur also mentions that, in Latin America, Brazil is the country with the highest tax burden. It is above Argentina (30,6%), which faces a long period of economic problems, as well as the region's average, which is 20,9%.

"By taking into account the bureaucracy of our tax system, according to a study by the World Bank, Brazil is also in a bad position," adds Abdenur. While in Switzerland - which has a similar load to that of Brazil - companies spend 63 hours to pay basic taxes, here the standard time is 2.600 hours, the worst in the world.

Former Federal Revenue Secretary and member of the ETCO Advisory Council Everardo Maciel presented one of the institute's proposals, whose main basis is to reduce bureaucracy.

For Maciel, there are some measures that can help in the process of simplifying and rationalizing the tax system. Among them is the unification of legal entities (CNPJ) in the federal, state and municipal registries. “We want to introduce this into the National Tax Code. It does not make sense for the same company to register in each of these units of the Federation ”, evaluates the former secretary of the Federal Revenue.

Another suggestion is that full anteriority be implemented. In other words, any change must have a deadline to be defined, which in the case of the ETCO proposal is until June 30 of the previous year. In the same vein, the institute suggests that the tax legislation for all taxes be consolidated by September 31.

The tax attorney and member of the ETCO Advisory Council Hamilton Dias de Souza presented the proposed regulation of Article 146-A of the Federal Constitution by means of a complementary law that may establish special taxation criteria, “with the objective of preventing competition imbalances, without prejudice to the competence of the Union, by law, to establish norms with the same objective ”. The intention is to allow states and municipalities to improve the competition of companies.

"This law does not create the criteria for taxation, but it allows the Union, States and municipalities to create them and it is up to a complementary law to create a framework for such taxes", explains Dias de Souza, who was one of those responsible for writing the article.