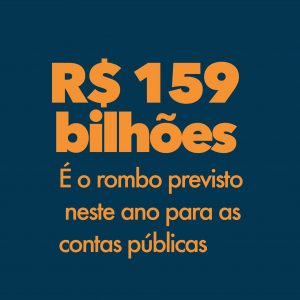

The accounts of the federal government, states and municipalities are increasingly without space to pay for pensions and civil servants' salaries. These expenses are growing at a much faster pace than the collection, and as there is no effective control of spending, the numbers do not close and the holes only increase.

The accounts of the federal government, states and municipalities are increasingly without space to pay for pensions and civil servants' salaries. These expenses are growing at a much faster pace than the collection, and as there is no effective control of spending, the numbers do not close and the holes only increase.

And, to change this worrying situation, the Minister of the Federal Court of Accounts (TCU), Augusto Nardes, warns that, in addition to the pension reform, it is necessary to improve governance in the management of public expenses, wiping out the staff. Only then will the government return to invest so that the country has greater and sustainable growth.

Nardes is categorical in stating that "the nation is unfeasible". He points out that, without improving the efficiency of public spending and without structural reforms, such as tax and Social Security reforms, the country will be obliged to do the same as Portugal and Spain, which reduced civil servants' salaries by 50%, as “Way to spare money for investment” and improve productivity. "The next president will need to have the courage to do this in order to make the country viable, because the nation is unfeasible," he says.

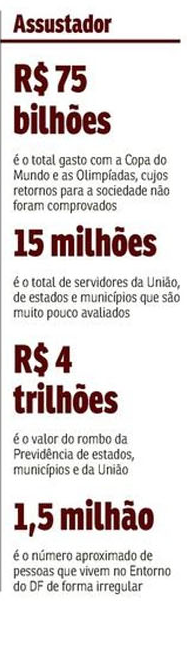

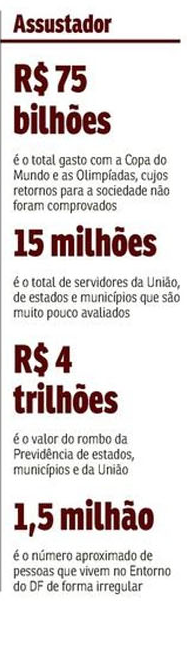

Book author From governance to hope, recently launched by Editora Fórum, Nardes praises the decree that provides for the adoption of governance measures in public administration as of May, No. 9.203, signed by President Michel Temer in November 2017. He classifies the measure as a first step in the right direction to ensure better efficiency of public spending. Because there are 15 million people working in the Brazilian state (municipalities, states and the Union) who are underestimated and sometimes are not even trained.

The minister was the rapporteur for the government accounts of former President Dilma Rousseff of 0, which were rejected by the TCU, paving the way for the PT's impeachment process. He has been following public finances closely since 2014 and admits that the data are not encouraging, but need to be shown and discussed by candidates for the Presidency of the Republic.

"We have to reduce public spending and, certainly, seek efficiency and effectiveness to avoid a collapse of the Brazilian State", he highlights. As an example of the government's inability to plan, Nardes cites billionaire losses in the overpriced works of four Petrobras refineries, which made the state's investments unfeasible.

“Comperj (RJ) has already made a loss of R $ 12,4 billion. At the Abreu e Lima refinery (PE), we found an overprice of R $ 2,4 billion. Not to mention the refineries in Ceará and Maranhão, which were not started, only made earthworks, in which we spent R $ 3,8 billion. So, the incapacity of the Brazilian State is monstrous ”, he stresses.

Foresight

Nardes also warns of the worrying deficit in Social Security. According to the accounts of the minister, the Federal Government, states and municipalities, they point to a combined loss of R $ 4 trillion, in values obtained by actuarial calculations brought to the present. Of this amount, R $ 2,8 trillion refers to regional governments and R $ 1,2 trillion to the Federal Government, adding public and private pensions. “We don't even have the capacity to pay who will retire tomorrow or the day after. We are in a situation of economic unfeasibility for the nation ”, he reinforces.

For the minister, this year, due to the elections, “it will be decisive for the country”, because the next president will need to rationalize the cost to make it feasible. He says he has been giving the warning to the government since 2014, but has not been heard. He even had a meeting with 22 of the 27 elected governors, but the plug did not fall ”among politicians. Examples of neglect abound, according to Nardes. “Virtually 50% of the thousands of daycare centers built are abandoned because there was no strategic planning between states and municipalities. Thousands of UPAs have been made and are also abandoned. Billions of reais have been thrown away ”, he criticizes. According to the minister's calculations, the government spent R $ 45 billion in the Rio 2016 Olympic Games and another R $ 30 billion in the 2014 World Cup, that is, R $ 75 billion that did not have an effective verification of the return for the society.

We have to start with a transformation of the nation and governance is the great background that the country needs to make a reflection. Collect, we know. Spend, we know. Throwing money in the gutter and in the wind is the simplest and easiest thing in the Brazilian state ”, he emphasizes.

Insecurity increases with lack of governance

The minister believes that the lack of governance in the Brazilian state is one of the reasons for military intervention in Rio de Janeiro.

The collapse in public security, according to him, is the result of poor border management, which facilitates smuggling and increases the population's insecurity.

“Our capacity at the country's borders is a failure. Several institutions that do not talk. Today, the IRS and the Federal Police are improving. I am monitoring a judgment in relation to this ”, he highlights, citing data presented by the president of the Brazilian Institute of Ethics in Competition (ETCO), Edson Vismona, that smuggling causes losses in the collection between R $ 130 billion and R $ 140 billion per year.

“A transformation of the nation is necessary. Leaders have to be aware of this role, which is not to impose but to motivate people to transform ”, he highlights.

In Nardes' assessment, the solution to the problem of chronic violence in Rio involves governance, not only in the administrative area of each state, but also among the police, who do not talk, mainly, those of the states that share borders with other countries. "The military cannot stay long and it is necessary to have a medium and long term strategy coordinated with the neighbors", he says, emphasizing that insecurity also surrounds the Federal District.

“We are facing a catastrophe also in Brasilia. We have 1,5 million people living illegally in the surroundings of DF. The number of public areas being invaded is impressive. And the state has no governance over its land, its heritage ”, he denounces. “There is a complete lack of governance around Brasilia. It is total in the surroundings of Rio de Janeiro. The one who commands is the crime, and, if we go to the street, in most of the Brazilian capitals, the picture is the same. Inability of the State to govern. What we live in the country is very serious ”, he highlights. Despite the bleak picture, the minister shows optimism about the elections, because he expects that "the plug will fall" for the next leaders who will be elected, and that they will commit themselves to facing this problem as a priority.

"We hope to have someone with the ability to bring confidence back, a sense of patriotism and investment to the country, because a good part is already leaving for Paraguay," he says.

For Nardes, more than 450 thousand Brazilians and 150 companies have already migrated to the neighboring country.

Source: Special section of the Correio Braziliense newspaper - Taxation and Development

In view of the difficult situation that government accounts are currently experiencing, with successive deficits since 2014, anything is possible. The prospect is that public accounts will only return to blue in 2021, at best. According to him. the debacle of the government's fiscal situation began in 2010, when the collection of the Union in relation to the Gross Domestic Product (GDP) started to fall. Revenues (before GDP) started to collapse even before the recession hit the scene. And spending continued its upward trend, ”he says.

In view of the difficult situation that government accounts are currently experiencing, with successive deficits since 2014, anything is possible. The prospect is that public accounts will only return to blue in 2021, at best. According to him. the debacle of the government's fiscal situation began in 2010, when the collection of the Union in relation to the Gross Domestic Product (GDP) started to fall. Revenues (before GDP) started to collapse even before the recession hit the scene. And spending continued its upward trend, ”he says.

The accounts of the federal government, states and municipalities are increasingly without space to pay for pensions and civil servants' salaries. These expenses are growing at a much faster pace than the collection, and as there is no effective control of spending, the numbers do not close and the holes only increase.

The accounts of the federal government, states and municipalities are increasingly without space to pay for pensions and civil servants' salaries. These expenses are growing at a much faster pace than the collection, and as there is no effective control of spending, the numbers do not close and the holes only increase.