Source: ETCO Magazine, No 18, January 2011

An Argentine beats in the heart of Brazil. The size of the Underground Economy in Brazil amounts to over 600 billion reais, equivalent to the total of all wealth produced in the neighboring country. Resources that escape the formal economic gear and thus feed social problems, hinder the choice of public policies and promote unequal competition between firms in the formal and informal economy.

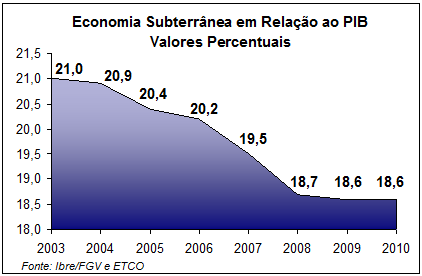

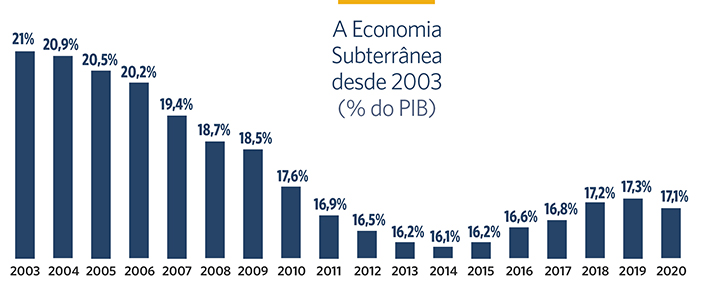

After spending five years - between 2003 and 2008 - growing less than GDP, the Underground Economy grew at the same speed as the Gross Domestic Product (GDP), reveals the Underground Economy Index released on November 24 by ETCO and the Institute Fundação Getulio Vargas (Ibre / FGV) Brazilian Economist, responsible for the study, with the 2009 revision and update for 2010. The ratio of the Index to GDP stopped falling, showing a stabilization trend at around 18,6% . This means that, in the last three years, the Underground Economy has grown at the same rate as GDP, which is worrying for the country's economy.

In absolute terms, the Brazilian underground economy surpassed, in 2010, the 650 billion reais mark. The value is equivalent to almost all the wealth generated by two of the three richest states in the country - Minas Gerais and Rio de Janeiro. The index takes into account a forecast of growth of 7,5% of GDP and inflation of 5% in 2010.

The estimate of the Brazilian Underground Economy in 2003 was equal to 21% of GDP and came in a gradual reduction until 2009, when it registered 18,7% of GDP. Despite the reduction as a fraction of GDP, in real values there was a growth of 19,8% in relation to 2003, when it reached 523 billion reais.

In the assessment of ETCO's executive president, André Franco Montoro Filho, the growth of the economy has a double and antagonistic effect on informality. “On the one hand, growth generates institutional modernization that encourages the formalization of economic activities, but on the other hand, income growth increases the consumption of goods and services, including those produced in the underground economy. The results released show that the second effect has been prevalent in recent years, ”said André Montoro, commenting on the figures.

It is, therefore, urgent that the new government make a deep reflection on the reasons for the current results, so that public policies that are really effective are elaborated, so that the importance of the Underground Economy in Brazil gradually becomes less. To estimate the size of this submerged part of the economy, the Ibre / ETCO index used two distinct methods: the currency demand method and the informal labor market method. The monetary method estimates a currency demand equation that, in addition to the classic variables such as the nominal interest rate and the real product per capita, adds variables that explain the demand for money due to the existence of the Underground Economy.

Activities that are not under the control of the State tend to work with more “cash” than formal activities in the economy and, therefore, would increase the demand for paper money. This is the justification for using the monetary method. The estimation of the size of the Underground Economy is, therefore, a result of the total demand for money and the demand for money less the factors of the Underground Economy. The methodology that uses labor market indicators uses data from the National Household Sample Survey (Pnad) to estimate the share of the number of unregistered workers among employed workers and the share of the income of unregistered workers in the total income of workers. employed workers. As the share of labor income in the total income of the Brazilian economy is around 60%, the Subterranean Economy is obtained through the average of these measures multiplied by 60%.

Finally, the size of the underground economy is estimated by the average of the two methods: the monetary method and informality in the labor market. An important factor in reducing the size of the Underground Economy as a proportion of GDP is the awareness that the population has of the losses of informality and the connection of this Underground Economy with crime. This awareness, requiring invoices and not buying products of illegal origin, is helping to reduce the weight of the underground economy. “Informal economy is a leniency of our colloquial language, as it is an illegal act to be combated”, declared Fábio Barbosa, president of the Brazilian Federation of Banks (Febraban) in an article published in August 2010 in the Folha de S. Paulo newspaper. Barbosa, for whom the ETCO and FGV study came at a good time, says that even with the downward trend in informality pointed out by the study, “there is no news that this path has made sectors unfeasible, or has caused great damage to the economy”.

In Brazil, an important part of the underground economy aggregates the informal economy, which, in general, is defined as workers who do not have a formal contract or those who do not contribute to Social Security. According to Barbosa Filho, a researcher at Ibre, the informal economy is easily observed. Official statistics on the informal economy indicate how regulated the Brazilian labor market is, which places around 30% of its employees in the informal sector.

The Underground Economy in Brazil is a legacy of a country that is still institutionally underdeveloped, not very mature from a social point of view. The analysis is by Ambassador Marcílio Marques Moreira, President of the ETCO Advisory Council. "From the point of view of the individual, a change would be necessary in the face of leniency with transgressions of all kinds, both in politics and in the economy," says Moreira. The Ambassador recalls that in the political field there are some recent signs of improvement, such as the Clean Record Law, but “we need a clean record law also for those who act in the economic area”, he says.

The high tax burden and corruption are the main causes of informality

“When the fabric factory whistle

Come hurt my ears

I remember you"

The beloved made cloth and the poet, next to the piano, took verses from one of the most traditional sectors of the economy. Neapolitans do not have as poetic an image of a fabric factory as the poet of the village, Noel Rosa, sang in the composition “Três apitos”. The image of the fabrics made in Naples is in the prose of journalist Roberto Saviano, author of the book Gomorra, with more than 1 million copies sold, which shows the reach of the Neapolitan mafia in the Italian economy and its expansion worldwide. Saviano tells us that the white suit that covered the body of actress Angelina Jolie during the Oscar ceremony in 2001 was cut into pieces by Camorra, the Neapolitan mafia that controls the manufacturing system in the Naples region, used by some international brands to outsource part their productions. Angelina, recognized for her social engagement, won the suit of a gift from an Italian dressmaker and probably had no idea of the origin of the fabric she carried on the red carpet, but the scene is emblematic when talking about the tentacles of organized crime in the Underground Economy.

For Noel Rosa, who would have turned 100 in 2010, the worst thing that happened was the pain of love:

“That I suffer cruelly

Jealous of the manager

Naughty ”

For the Italian journalist, the consequences of his prose were more serious. Saviano has lived under the permanent escort of five policemen, since October 13, 2006. He constantly changes his address, and does not frequent public places, due to death threats made by mobsters. Vito Tanzi, a renowned consultant economist at the World Bank, often uses the emblematic image of Angelina Jolie and her suit to illustrate the size of the Underground Economy in the XNUMXst century and its reach even to people of good faith.

The Underground Economy is the set of activities not declared to the government that aim to evade taxes, evade contributions to social security, evade compliance with labor laws and regulations or avoid costs arising from complying with rules applicable in a given activity. Described like this, the Underground Economy even seems like Zé Carioca's, the Brazilian parrot and trickster created by Walt Disney who lives to deceive, lie, cheat, always trying to take advantage in all situations. In real life, however, it is bloodier and the figure of the good-looking parrot is supplanted by violent crimes.

Tanzi was one of the speakers at the international seminar Underground Economy - Causes and Consequences, promoted by the ETCO Institute in 2008. On the occasion, businessmen, academics and government officials met with two of the greatest authorities on the topic: Tanzi, one of the first economic thinkers to study the Underground Economy, for almost 30 years; and Austrian professor Friedrich Schneider, professor at the University of Linz, Austria. According to Tanzi, the Underground Economy has existed since the formation of the State, when there was a need for taxation, but it only entered the economic debate from the 70s, when it started to grow as the weight of taxes, norms increased , bureaucracy and corruption. He is a pioneer in the investigation of this topic and one of his studies has become a reference in the methodology of evaluation of Underground Economy.

In recent years, ETCO has invested financial and intellectual capital in the construction of one of the largest dossiers available in Brazil today on the Underground Economy (work is underway) https://www.etco.org.br/index. php). The objective of these studies, seminars and debates promoted by ETCO is to find ways and ideas that can lead to a reduction in informality in Brazil. "Tax evasion, informality and other misconduct distort the business environment, prevent investments and reduce growth," says Professor André Montoro Filho, ETCO's executive president. Hence the need to understand how the underground economy works in order to identify the most efficient ways of fighting. In these years of study and intense investigation, it became clear how much the normative complexity, the high tax burden and corruption contribute to feed informality. For Professor Fiederich Schneider, who created a calculation methodology to estimate the underground economy of a country, Brazil needs deeper reforms in tax and social security issues to lessen the impact of the so-called invisible economy. Another important source of energy for informality is the government's heavy hand in labor relations. The exemption from payroll is another topic of paramount importance for the reduction of informality in Brazil.

Professor Samuel Pessoa, from the Brazilian Institute of Economics (Ibre), linked to the Getulio Vargas Foundation (FGV), is the author of a paper on the impact of the payroll tax exemption. According to the professor, the tax burden on the formal sector creates a wedge between the remuneration paid and the received and this can reduce GDP, as people have the possibility to choose the informal sector, which is less productive. This wedge on the labor market, according to Pessoa, is 30% (the difference between paid and received by the Brazilian worker) and is equivalent to a rate of 43%, which is paid by the employer. "When releasing the payroll, many will go to formal employment and there will be an increase in profitability and in the capital accumulation process", says Pessoa.

During this period of intense study and research on informality, FGV and ETCO invested in building an index to monitor the behavior of the Underground Economy in Brazil. This index is estimated by a method developed by Karl Jöreskog and Arthur Goldberger and has the advantage of ordering the factors that most affect the underground economy, which facilitates economic policy prescriptions for the problem.

Called MIMIC (Multiple Causes, Multiple Indicators), this method starts from the idea that, although the Underground Economy is not observable, it leaves some “traces” in the economy (the indicators) and is encouraged by some factors (the causes). The “tracks” of the Underground Economy used to create the index were: the fraction of workers without a license on the total of employees and the ratio between paper money held by the public (PMPP) and demand deposit (DEP).

The Ibre / ETCO Underground Economy index links the growth of the Underground Economy with the GDP growth of the Brazilian economy. In periods when the growth of the Underground Economy is higher than the growth rate of the formal economy, the index increases, and in periods when the formal economy grows more than the Underground Economy, the index decreases. In an effort to combat informality and unfair competition, ETCO encourages studies and analysis on the underground economy, its causes and relationships with the formal economy to increase our knowledge of the problem.

In 2009, the launch of the book Subterranean Economy - A contemporary view of the informal economy in Brazil, edited by Campus with ETCO sponsorship, brought together texts from leading experts on the subject. Right in the preface to the book, Everardo Maciel, Federal Revenue Secretary under the Fernando Henrique Cardoso administration, notes that the increase in the tax burden can only be understood as a factor that induces tax evasion and, eventually, the Underground Economy when it results from an increase in the nominal rate. or basis of calculation - what he qualified as fiscal pressure. The works gathered in the book, despite the different views, converge to the conclusion that, without a deeper knowledge of informality, its causes will not be adequately addressed, and it will not substantially regress, to the detriment of competition.

ETCO seeks to raise awareness among the population and specific audiences - such as the public and private sectors - about the losses generated by the underground economy and the advantages of competitive ethics. It also proposes and supports public and private initiatives that help to reduce the underground economy. These actions can be both to facilitate compliance with the law and to reduce the tax burden, labor bureaucracy and support for initiatives that improve inspection and punishment for violators.

The ETCO President warns: “It is important for the population to be aware of the damage caused by the Underground Economy. It is necessary to reduce bureaucracy, reduce the tax burden in order to make it easier to comply with tax and labor obligations. In addition, it is necessary to establish more agile and easier mechanisms for monitoring these obligations ”. Well-informed Brazilians in good faith are more attentive to escape the subtle traps of organized crime and begin to see the extent to which careless acts of buying a film (pirate) in the friendly salesman who is on their daily journey home to work it is the visible face of mobster schemes that have even reached the Oscar red carpet.

Book brings the arguments of the world's leading experts on the subject, originally addressed at a seminar held by ETCO

Book brings the arguments of the world's leading experts on the subject, originally addressed at a seminar held by ETCO