Crisis makes underground economy grow after 11 years, point ETCO and FGV / IBRE

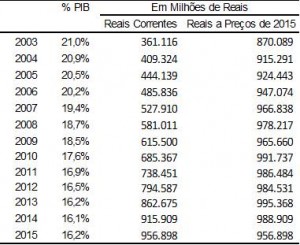

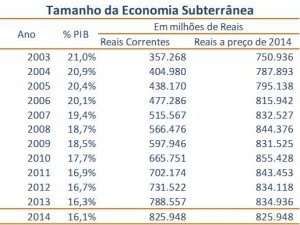

Study shows that the informal market moved R $ 957 billion in 2015, corresponding to 16,2% of the Brazilian GDP

The economic crisis that the country is going through does not only result in a drop in GDP (Gross Domestic Product) or an increase in unemployment levels. It has also proved to be a strong driver of the resumption of growth in the informal market, which grew for the first time since 2004. This is what the Underground Economy Index (IES) points out, released by the Brazilian Institute of Ethics in Competition (ETCO), together with the Brazilian Institute of Economics of Fundação Getulio Vargas (FGV / IBRE).

The underground economy is the production of goods and services not reported to the government deliberately to evade taxes, evade social security contributions, circumvent compliance with labor laws and regulations and avoid costs arising from complying with the rules applicable to each activity.

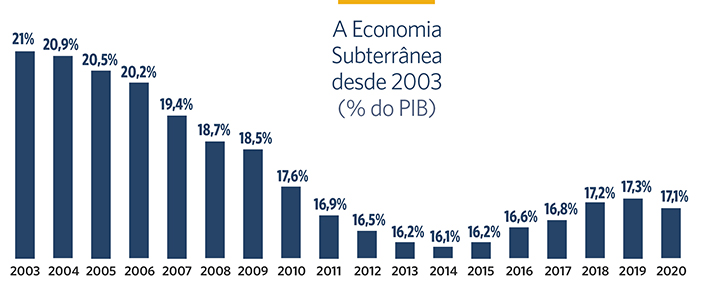

Since the index was created, this is the first time that the study shows a reversal of the trend. Until 2014, the Underground Economy Index had a gradual decline each year, from 21% of GDP in 2003 to 16,1% in the previous survey. According to the study by ETCO and FGV / IBRE, in 2015, the informal market moved R $ 957 billion, corresponding to 16,2% of the Brazilian GDP, which represents an increase of 0,1 percentage point in relation to the previous measurement .

For FGV / IBRE researcher, Fernando de Holanda Barbosa Filho, the result is directly linked to the 2015 macroeconomic scenario. “The economy is slowing down, as well as credit, which directly impacts formal work, which naturally falls, giving way informality ”, he explains. According to him, the result is not only worse thanks to the consolidation of measures to combat informality.

ETCO's Executive President, Evandro Guimarães, also emphasizes the importance of continuing public policies to contain informality, such as tax relief, expanding the use of electronic invoices, reducing bureaucracy in tax processes and measures aimed at small business owners. “Informality brings direct damage to society, creates an environment of transgression, stimulates opportunistic economic behavior, with a drop in the quality of investment and a reduction in the growth potential of the Brazilian economy. In addition, it causes a reduction in government resources for social programs and investments in infrastructure ”, he explains.

About the Shadow Economy Index

ETCO believes that knowing the size of the problem is critical to tackling it. Much is said, but little is known, about informality, piracy and evasion, as, as illegal activities, they are difficult to measure. The ETCO, in conjunction with the Brazilian Institute of Economics of the Getúlio Vargas Foundation (FGV / IBRE), has been publishing since 2007 the Underground Economy Index, a study that estimates the values of activities deliberately not declared to public authorities, with the objective of evading taxes, and those of those who find themselves in the informal sector due to excessive taxation and bureaucracy.