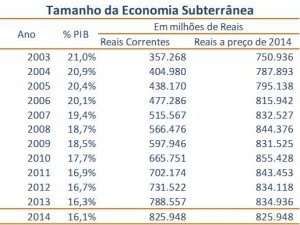

São Paulo, June 25, 2015 - The Underground Economy Index (IES), released today by the Brazilian Institute of Competitive Ethics - ETCO together with the Brazilian Institute of Economics of the Getulio Vargas Foundation (FGV / IBRE), showed that the informal market moved R $ 826 billion in 2014 This figure represents 16,1% of the country's Gross Domestic Product (GDP) and points to a slight reduction of 0,2 percentage point in relation to the previous year.

The analysis is that the drop in informality has been losing strength due to the stagnation of the economy. “The economic slowdown started at the end of last year, so that the results of the crisis will only be really felt in its next edition, referring to the year 2015. The measures taken by the government to combat informality, such as the exemption of some sectors of the economy and policies aimed at small business owners, although effective, are not enough to curb informality in this scenario ”analyzes Samuel Pessoa, a researcher at FGV / IBRE.

In absolute values and updated prices, in 2014 there was a drop of only 1% in the index, which corresponds to the production of goods and services not deliberately reported to the government and, therefore, is outside the national GDP. Last year, this amount totaled R $ 835 billion.

In the past ten years, the Shadow Economy Index has dropped 4,8 percentage points. With the exception of 2009 - an atypical year for the economy due to the global crisis - from 2007 onwards, the HEI dropped 0,7 pp, from 20,2% in 2006 to 17% in 2011. The years 2012 and 2013 were marked by the beginning of the deceleration process, a direct consequence of the sharp drop in the number of formal hires by the industry and growth in the service sector, which has higher levels of informality than the industry. 2014 stands out for being the year in which the Index revealed, for the first time, an almost stagnation in the rate of decline of the underground economy in the Country, in its relationship with the Gross Domestic Product (GDP).

“In order for us to resume the significant drop in informality, it is essential to seek measures capable of simplifying and rationalizing the tax system; modernize the collection system and make compliance with the law less painful for the population. It is also necessary to continue and accelerate the structural changes that we seek for society, such as, for example, increasing the educational level and reducing the unemployment rate, ”says Evandro Guimarães, ETCO's Executive President.

What is certain is that informality brings direct damage to society, creates an environment of transgression, stimulates opportunistic economic behavior, with a drop in the quality of investment and a reduction in the growth potential of the Brazilian economy. In addition, it causes a reduction in government resources for social programs and investments in infrastructure.

About the Shadow Economy Index

ETCO believes that knowing the size of the problem is critical to tackling it. Much is said, but little is known, about informality, piracy and evasion, as, as illegal activities, they are difficult to measure. The ETCO, in conjunction with the Brazilian Institute of Economics of the Getúlio Vargas Foundation (FGV / IBRE), has been publishing since 2007 the Underground Economy Index, a study that estimates the values of activities deliberately not declared to public authorities, with the objective of evading taxes, and those of those who find themselves in the informal sector due to excessive taxation and bureaucracy.