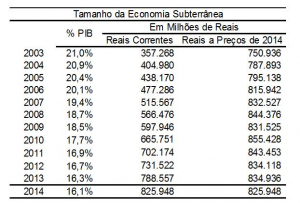

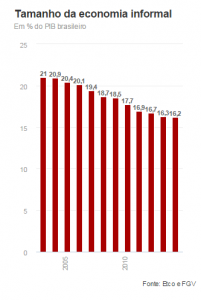

The ETCO-Brazilian Institute of Ethics in Competition and the Brazilian Institute of Economics of the Getúlio Vargas Foundation (FGV / IBRE) released in June the 2014 Underground Economy Index (IES). According to the indicator, last year, the informal market amounted to R $ 826 billion. The figure is equivalent to 16,1% of the Gross Domestic Product (GDP) and shows a decrease of 0,2 percentage point in comparison with the index obtained in 2013. The small variation points to a scenario of almost stagnation in the trend of falling participation. of the informal economy in Brazil. In the last 10 years, the index has decreased by 4,8 percentage points.

The ETCO-Brazilian Institute of Ethics in Competition and the Brazilian Institute of Economics of the Getúlio Vargas Foundation (FGV / IBRE) released in June the 2014 Underground Economy Index (IES). According to the indicator, last year, the informal market amounted to R $ 826 billion. The figure is equivalent to 16,1% of the Gross Domestic Product (GDP) and shows a decrease of 0,2 percentage point in comparison with the index obtained in 2013. The small variation points to a scenario of almost stagnation in the trend of falling participation. of the informal economy in Brazil. In the last 10 years, the index has decreased by 4,8 percentage points.

The IES uses a set of statistical data to estimate the size of activities not declared to the government, such as smuggling, piracy, tax evasion and informal employment. The survey, which until 2012 had registered a significant drop in these activities, started to have a slower rate of reduction in recent years. One of the main reasons was the retraction of the industry and the growth of the service sector, which has higher levels of informality. According to the researchers, the reduction in the fall may also be related to the slowdown of the Brazilian economy in the last year.

HIGH TREND

The study authors believe that the worsening of the economic scenario in 2015 may cause a reversal of the index. “The economic slowdown started at the end of last year, so that the results of the crisis will only be really felt in its next edition, referring to the year 2015 ″ analyzes Samuel Pessoa, a researcher at FGV / IBRE. According to him, the measures taken by the government to combat informality, such as the exemption of some sectors of the economy and policies aimed at small entrepreneurs, although effective, are not enough to curb informality in this scenario.

For the country to be able to continue reducing the underground economy, new initiatives by the government are necessary. “In order for us to resume the significant drop in informality, it is essential to seek measures capable of simplifying and rationalizing the tax system; modernize the collection system and make compliance with the law less painful for the population. It is also necessary to continue and accelerate the structural changes that we seek for society, such as, for example, the increase in educational level and the reduction of the unemployment rate ”, says Evandro Guimarães, president of ETCO. “We are at most 40% of the way to go.”

ETCO's partnership with FGV / IBRE aims to monitor developments and draw society's attention to the size of the informal economy. The survey released in June had a wide repercussion in the media, with reports in 124 media outlets. The list includes important newspapers such as O Estado de S.Paulo and Correio Braziliense and major news portals, such as G1 and Exame.com.

To expand the spread, this year ETCO prepared a video about the results of the research, which can be seen at this address.