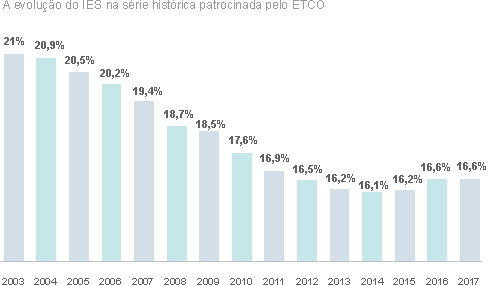

After growing for two consecutive years, the underground economy stabilized in 2017 and returned to represent 16,6% of the Gross Domestic Product (GDP). The calculation is from the Underground Economy Index (IES), a study carried out in partnership by the Brazilian Institute of Ethics in Competition (ETCO) and the Brazilian Institute of Economics of the Getúlio Vargas Foundation (FGV / Ibre).

Informality in the country generated, in the 12 months ended in July, the equivalent to R $ 1,077 trillion. The number represents the GDP of countries like Colombia and South Africa. The underground economy is the production of goods and services not reported to the government deliberately, with the aim of evading taxes, evading social security contributions, circumventing compliance with laws and labor regulations and avoid costs arising from compliance with the rules applicable to each activity.

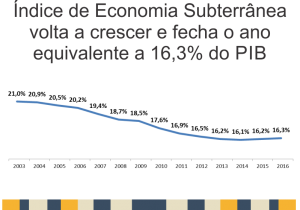

The IES has been held since 2003 and, until 2014, registered a constant improvement in the level of formalization of business in Brazil. During this period, the shadow economy fell from 21% to 16,1% of GDP. In 2015, the index suffered its first setback since the beginning of the historical series, a situation that worsened last year.

Size of the underground economy

Size of the underground economy

An important point for the resumption of the formal economy to take place, and to continue in the coming years, is labor reform. “ETCO's expectation is that the new CLT rules will bring about a safer environment for employers and workers. As a consequence, the judicialization of contracts tends to decrease and there will be more incentives to increase the number of employees with a formal contract ”, says ETCO's executive president, Edson Vismona.

Despite the prospect of future improvement, Vismona points out that the country cannot be content with just recovering what was lost in the past two years, without further progress. “A country that intends and needs to attract investments in order to develop cannot accept living with such high levels of informality”, he adds.

According to Fernando de Holanda Barbosa Filho, a researcher at FGV / Ibre, the informal market stopped growing with the end of the recession, but that was not enough to reverse the downward trend of the index. "With the prospect of GDP growth of more than 2,5% for 2018, the trend is for the economy to improve as a whole and positively impact the formalization of business in Brazil," he highlights.

About the Shadow Economy Index

ETCO believes that knowing the size of the problem is critical to tackling it. Much is said, but little is known, about informality, piracy and evasion, as, as illegal activities, they are difficult to measure. The ETCO, in conjunction with the Brazilian Institute of Economics of the Getúlio Vargas Foundation (FGV / Ibre), has since 2007 published the Underground Economy Index, a study that estimates the values of activities deliberately not declared to public authorities, with the objective of evading taxes, and those of those who find themselves in the informal sector due to excessive taxation and bureaucracy.