po MÁRCIA DE CHIARA - THE STATE OF S.PAULO

Slice of informality increased to 16,2% last year, according to the FGV and ETCO indicator

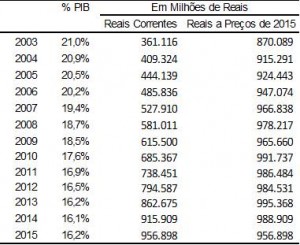

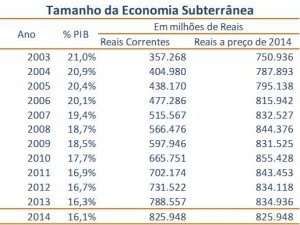

Driven by the crisis, the participation of the informal economy in the Brazilian Gross Domestic Product (GDP) increased again in 2015, after 11 years of consecutive falls. Last year, the share of the underground economy in all the wealth generated in the country was 16,2%, points out the Underground Economy Index (HEI), ascertained by the Brazilian Institute of Economics (Ibre) of the Getúlio Vargas Foundation (FGV), in partnership with the Brazilian Institute of Competition Ethics (ETCO). In absolute numbers, R $ 956,8 billion of wealth was generated informally last year.

KNOW MORE: UNDERSTAND THE UNDERGROUND ECONOMY INDEX (HEI)

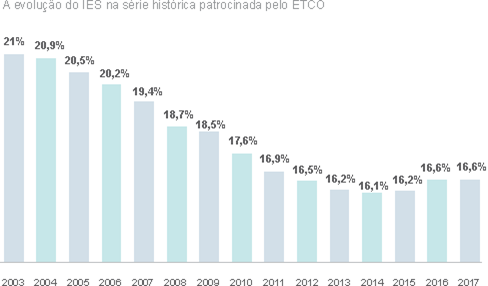

In 2003, when the indicator started to be calculated, the underground economy accounted for 21% of GDP. Since then, IES fell year on year and reached 16,1% in 2014. Last year, due to the crisis, there was a reversal of the fall: the underground economy had a slight growth and advanced 0,1 percentage point in the compared to 2014. According to FGV, the underground economy includes the production of goods and services not declared to the government to evade taxes and contributions in order to reduce costs.

"The vigor of the crisis affected the entire economy, including the underground economy, which registered growth," observes Fernando de Holanda Barbosa Filho, a researcher at Ibre / FGV and responsible for the indicator.

The economist says he expected a higher increase in the indicator, which, according to him, was mitigated by a certain resistance in the labor market. The shadow economy index is calculated from two groups of indicators. One of them is the population's demand for cash, which normally grows when informality increases, as this is a way of circumventing the tax authorities. The other group is the indicator of informal work.

Barbosa Filho explains that the demand for cash grew from 2014 to 2015, but the informality of work was practically stabilized. "As it took time for the labor market to worsen, the increase in the informal economy's share of GDP was only 0,1 percentage point," says the economist.

For this year, he expects a greater advance in the share of the informal economy in the Brazilian GDP. Anyway, after the crisis, Barbosa Filho believes that the share of the underground economy in GDP should fall again because, in his assessment, the institutions to reduce the size of the underground economy continued to function. "What led to this increase in informality was the size of the crisis."

Simple. Looking at the indicator for a longer period, ETCO's executive president, Evandro Guimarães, makes a different analysis. He notes, for example, that since 2012 the shadow economy indicator has been around 16% of GDP, which, in his opinion, signals a certain stabilization.

“The rate of decline in the shadow economy, which had been systematically pointing to a significant reduction, stopped falling as it did before”, says Guimarães. Between 2003 and 2012, the reduction in the shadow economy's share of GDP was five percentage points. The ETCO president points out that some institutional mechanisms that helped in this reduction are being “expired”.

Among these mechanisms, he points to the implementation of Simples and individual micro-enterprise (MEI). “Also other employment and income efforts that have lost their relative effectiveness at the moment,” he says. For Guimarães, Simples is no longer a vigorous instrument of formalization. “The fact that the company is in Simples does not mean that it has 100% of the operation formalized. We have always seen in the news and in real life that companies that adhere to Simples also have a share of informality in their operations. ”

The ETCO president defends a re-evaluation of the inspection instruments. “We perceive a small real effort to evaluate the existing mechanisms.”

Article published in the newspaper O Estado de São Paulo, on 28/06/2016.