Source: The State of S. Paulo (São Paulo - SP) - July 23, 2012

by Roberto Abdenur *

The Underground Economy Index (IES) brings good news, a study that estimates the values of activities deliberately not declared to public authorities in order to evade taxes and those of those who are in the informal sector due to excessive taxation and bureaucracy. In 2011 it represented 16,8% of the gross domestic product (GDP), which corresponds to R $ 695,7 billion.

The news is very good because, in the previous year, the estimated size of the HEI was 17,7% of GDP, or R $ 715,1 billion. The study on the IES has been carried out by the Brazilian Institute of Economics of the Getúlio Vargas Foundation, together with the Brazilian Institute of Ethics in Competition (Etco) since 2003, when the underground economy was estimated at 21% of GDP.

Between 2004 and 2006 the estimated size of this economy was around 20%. In 2007 it dropped to 19,5%, as a result of the increase in formal work. The economic situation in the country, the growth of class C and the good prospects for the future confirmed the trend towards formal employment. In 2008 and 2009, the HEI was 18,7% and 18,5%, respectively, which continued to confirm the trend towards a reduction in activities that are outside the formal economy.

Here comes the alert. Reaching the levels of developed countries - where IES is around 10% - seems distant, despite the number of 2011 (16,8%). It is that the downward trend may be temporarily reaching its limit in Brazil, due to the loss of dynamism in the economy and the reduction in the pace of credit growth.

The loss of dynamism in the economy is reflected in the prospect of a lower GDP. This tends to affect the labor market, which increases household indebtedness and makes credit difficult. The moment of wonder passed with the consumption of the new middle class, when realizing that everything depended on numerous installments to be honored.

In addition to the slowdown in the economy, the high tax burden is also a factor in the informalization of activities in the country. The current tax system raises the cost of industrial production, impairs internal and external competitiveness, discourages investments, decreases consumption, increases unemployment. , encourages tax evasion and, as a general result, contributes to informality and the underground economy.

Comparing tax burden and GDP per capita, Brazil is very poorly placed, according to data from the World Bank. Taxes in the country (36% of GDP) are at the same level as Russia, Ireland and Australia and exceed the United States and South Korea. But these countries have GDP per capita higher (three to five times) than ours. On the other hand, our taxes exceed those of countries like China and India, in addition to Argentina and Mexico, which have GDP per capita more similar to that of Brazil and compete with us.

Tax collection is vital for the State, but the tax system must be in harmony with other factors inherent to economic activity. In Brazil, in addition to the high tax burden, the problem lies in the complexity of paying taxes and the rigidity of legislation for those who work in legality.

Another World Bank study, called Paying Taxes, showed that, in 2008, a standard company spent no less than 2.600 hours a year to pay basic taxes in Brazil. It was the worst result in the world. In the United Arab Emirates, for example, it was 12 o'clock; in Switzerland, 63; in Venezuela, 864.

The time spent is a direct consequence of the complexity of tax legislation, which from 1988 to 2005 had an incredible 3,4 million rules issued. The delay in simplifying and rationalizing the tax system has been one of the biggest obstacles to the modernization of the Brazilian economy. To the extent that such complexity is used as a justification for tax evasion, it benefits transgressors, deteriorates the business environment, removes investments and reduces the country's growth potential.

A simpler system, on the contrary, encourages the productive sector, encourages consumption, promotes formal employment, raises workers' income, reduces tax evasion and reduces informality. At this stage, it is not a matter of promoting a broad tax reform - which may require years of debates and adjustments -, but of studying specific proposals that may have almost immediate results. Among these proposals are the unification of taxes and fees with the same calculation basis and taxable event, such as goods and services (IPI, ICMS, ISS), billing (PIS, Cofins), income (IR, Social Contribution) or imports (IPI , ICMS, ISS, Cofins, tariffs).

In view of the trend pointed out by the Underground Economy Index and the global scenario, a joint effort is now needed - between the Executive, Legislative and Judiciary Powers with society - to stimulate formality in the Brazilian economy.

We live in a unique moment in our economic history, favorable for the revision of a series of rules that, historically, prevent the healthy growth of our economy. President Dilma Rousseff's commendable effort to end the so-called fiscal war and move forward in the modernization of tax rules, as well as the institution of individual micro-entrepreneurs - just to mention two recent facts - are examples among countless proposals that must be evaluated and put into practice. practice.

It is clear that there is only one way to reduce the size of the shadow economy. And this path consists of five measures: improving the tax system, reducing tax evasion, reducing illegal trade and piracy, reducing the informal economy and, not least, fighting corruption. We have made progress on these fronts, but much remains to be done.

* DIPLOMATA, IS EXECUTIVE CHAIRMAN OF ETCO

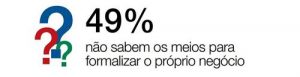

The survey also reveals that three out of five (61%) informal workers intend to make investments in their own business this year. However, 75% say that, for this, they will have to put their hand in their own pocket, while only 14% will resort to banks or finance companies. Most say they want to expand the activity, but do not intend to formalize it because they say they fear bureaucracy, a drop in income and new costs.

The survey also reveals that three out of five (61%) informal workers intend to make investments in their own business this year. However, 75% say that, for this, they will have to put their hand in their own pocket, while only 14% will resort to banks or finance companies. Most say they want to expand the activity, but do not intend to formalize it because they say they fear bureaucracy, a drop in income and new costs.