Senator Ana Amélia talks about her Bill to fight companies that use tax defaults to win the market

They act this way in a systematic way, differentiating themselves, therefore, from that taxpayer who, in a difficult moment, fails to collect taxes, but shows an intention to regularize his situation.

Tax evasion in Brazil is a crime. The guilty can even go to prison. There is, however, a practice that causes practically the same losses as tax evasion, but it is not considered a crime and its fight has been very difficult in the country. This is the usual tax default, which occurs when the company informs its sales to the tax authorities , but simply does not pay taxes.

The consumptive debtor benefits from the lack of specific legal instruments to combat it and from the slowness of Justice to drag collection proceedings for years - often by working through oranges that, when the shares are definitively lost, have no equity to settle debts that millionaires. Meanwhile, it uses the advantage of unpaid tax to lower its prices and conquer the market at the expense of honest competitors, destabilizing the market.

The good news is that this practice may have its days numbered. In August, Senator Gaúcha Ana Amélia Lemos (PP-RS) presented a Bill to the Senate (PLS 284/2017) that regulates Article 146-A of the Constitution, allowing the creation of special taxation and inspection regimes. The initiative creates conditions for a much faster combat and effect of this type of company and has the support of ETCO.

A journalist with almost 40 years of professional experience, 31 of which covering Brasília's affairs for Rio Grande do Sul's RBS network, Ana Amélia entered politics in 2010. In her first race, she was elected senator with more than 3,4 million votes. Since then, she has stood out in Congress: she was chosen four times as one of the ten best senators in the Congress in Focus award, in 2013 she was appointed by the Inter-Union Department of Parliamentary Advisory (Diap) as the most influential woman parliamentarian in the National Congress and currently occupies second place in the Political Ranking, a survey that evaluates the legislative production of the 594 congressmen (senators and deputies).

On November 10, Senator Ana Amélia spoke about the purposes of PLS 284/2017 in an exclusive interview with ETCO Magazine.

Senator, your project seeks to regulate article 146-A of the Constitution. What is the main purpose of this constitutional article?

Senator Ana Amélia: Article 146-A of the Federal Constitution was formulated to prevent the use of tax as an instrument of competitive imbalance. The complementary bill (PL 284/2017) will allow not only the Union - which has always had the competence to deal with the issue - but also the States, the Federal District and the Municipalities to establish special differentiated taxation and inspection regimes, to neutralize the effects of taxes on competition.

In recent years, several business segments have been suffering unfair competition from companies that resort to illicit advantages, such as persistent tax defaults, to gain market share. Is the objective of the project to combat them?

Senator Ana Amélia: The bill establishes special taxation criteria, with the objective of preventing competition imbalances, without prejudice to the Union's competence, by law, to establish rules with the same objective. The intention is to avoid fraud, tax evasion, or even the use of persistent bad debt as a means for unscrupulous companies to increase their revenue and profit, gaining the market unfairly and harming competition. The project, therefore, has a broad spectrum, enabling the prevention of competitive imbalances regardless of how the tax is used to harm the Treasury and competition, including recurrent tax defaults.

How do you see the losses that the regular tax debtors cause to society?

Senator Ana Amélia: The Movimento Combustível Legal website informed, based on a study by the Getúlio Vargas Foundation, that tax evasion in the fuel sector today is R $ 4,8 billion. It is money that could be raised and invested in investments in health, education, security and infrastructure. Whoever commits this crime takes advantage of loopholes in the legislation that allow the habitual debtor to continue exercising the activity even if he has debts with the State. The persistent debtor obtains disproportionate advantages in relation to that competitor who works legally, since he has a much greater margin to work. Tax evasion impacts directly and negatively on citizens' lives. The money that would be paid in tax related to the sale of fuels could be reverted to services aimed at the population, since more than half of the amount charged to the driver, at the pump, is a tax. Tax evasion creates an environment of unfair competition, harming legally working dealers and distributors. Another crime that needs to be fought and that harms the consumer is adulteration in the fuel, as it pollutes the environment, and fraud at the pump weighs on consumers' pockets.

How can the creation of special taxation regimes help to combat these unfair practices?

Senator Ana Amélia: The special regimes consist of differentiated ways of complying with tax obligations in order to make it possible to collect the taxes legally provided for. When traditional means of collection do not work, due to practices adopted by debtors with a view to circumventing them, there is a need to provide the Tax Administrations with adequate tools to combat them efficiently. That is the objective of PL 284/2017.

Has the Supreme Court maintained the same jurisprudence?

Senator Ana Amélia: The Federal Supreme Court has precedents (70, 323 and 547) that prevent the adoption of indirect coercive means to compel the taxpayer to collect taxes, such as, for example, the imposition of special serious regimes that prevent the regular exercise of economic activity. However, in RE 550.769 and in ADI 173, the Supreme Court noted that the guidance contained in such overviews does not apply when the taxpayer uses the default of the tax as a means to explore his activity and gain market, because, in this case, the exercise of economic activity becomes illegal and, as such, does not deserve judicial protection. In this scenario, the principle of free competition must be respected.

Does the Supreme Court's new understanding seek to protect the market balance?

Senator Ana Amélia: Yes, in a weighting of values, the Supreme Federal Court understands that free competition should prevail over free initiative, when the abusive exercise of economic activity is verified, with systematic and unjustified default of taxes. In this way, the protection of the market is sought, considered national heritage by the Constitution (art. 219).

Today, because of the legal confusion, the collection processes of persistent debtors last more than ten years - and in that period the company causes great competitive damage. If your project is approved, will the solution be faster?

Senator Ana Amélia: This is also one of the purposes. The definition of clear taxation and inspection rules can speed up solutions and this will be beneficial not only to prevent unfair competition, but to prevent other irregularities that harm consumers and the environment. The project will separate the eventual debtor, who sometimes faces a problem and does not pay the tax for a specific period, but then makes an agreement and settles the debt, from that debtor who never pays the tax. Thus, the judiciary will be able to identify more accurately to make its decision. In addition, the Tax Administration may, in extreme situations, suspend or cancel the debtor's registration in the taxpayer register, which will allow the problem to be solved at its birthplace, avoiding the prolongation of its harmful effects on the market and society as a whole.

Could you summarize the main points of the project?

Senator Ana Amélia: The project foresees that the Union, states and municipalities can establish criteria for the fulfillment of tax obligations, such as, for example, special control over tax collection, maintenance of uninterrupted inspection in the establishment of a taxable person, anticipation or postponement of the taxable event and concentration of tax liability. incidence of the tax at a certain stage of the economic cycle, among other measures. It also provides for the alteration of the taxable person's situation in the taxpayer register to the suspended or canceled modalities. If the infractions persist, or if there is evidence that the company was constituted for the practice of structured tax fraud and for the production or commercialization of a stolen product or in non-compliance with the standards established by current legislation, this will be the treatment. The intention is to guarantee transparency and due process, without prejudice to the consumer and the owners of the establishments that work in compliance with the rules and ethical principles of the activity. The initiative also targets highly taxed sectors, such as beverages and cigarettes.

What are the types of punishment foreseen in the project?

Senator Ana Amélia: The bill determines that the administrative authority can change the status of the taxpayer in the taxpayer register to the suspended or canceled modalities. The suspension takes place when the infractions that motivated the application of a special regime persist, or the company does not have authorization from the regulatory agent or the competent supervisory body. The cancellation would be justified by reasons such as evidence that the company was constituted for the practice of structured tax fraud and for the production, commercialization or storage of stolen, stolen, falsified, adulterated goods or in non-compliance with the standards established by the regulatory agent or agency competent inspector.

Does the project preserve taxpayers' rights of defense?

Senator Ana Amélia: Yes, it provides for the prior summons of the taxpayer to exercise the right of defense, within a period of not less than fifteen days, and ensures the lodging of an appeal, without suspensive effect, which must be heard in up to ninety days, under penalty of immediate cancellation. differentiated regime, in addition to the individual application of the administrative authority, for up to twelve months, extension allowed by reasoned decision.

The project seeks to serve a noble and important cause, which is the fight against unfair competition. But can't it be used by states, municipalities or the Union in a distorted way just to increase revenue? Does the project make the limits clear to prevent this from happening?

Senator Ana Amélia: It cannot be used in a distorted way to increase tax collection because the special taxation criteria, foreseen in the project, are not apt to generate an increase in taxes. They only make it possible to collect the taxes already provided. In addition, its application must be preceded by a motivation that demonstrates the need, adequacy and calibration of the measures taken to protect free competition.

Can the differentiated regime be used in any sector and for any tax or does the project limit its application?

Senator Ana Amélia: The bill provides that the law is valid for any sector of economic activity in which there is a need to use differentiated tax instruments to ensure the smooth functioning of the market, with an emphasis on those in which tax is a relevant component in the composition of product prices or services and in which the structure of the production or marketing chain undermines the efficiency of controlling different forms of tax evasion. Only taxes levied on income, profit, financial transactions or equity are out of the reach of the project, given the characteristics of these taxes, which make them less likely to influence competition.

Senator Ricardo Ferraço had been chosen to be the project's rapporteur, but he excused himself at the end of October. How is the project now? What will be the next steps and what is your forecast regarding when it can be voted on?

Senator Ana Amélia: Senator Ricardo Ferraço's name is still listed as a rapporteur on the Senate portal. However, I imagine that, due to the 120-day leave, a new rapporteur may be appointed in the Economic Affairs Committee. From there, we will wait for the presentation and vote of the text in the committee. After that, the bill will still need to pass the Senate Plenary. Then he goes to the Chamber of Deputies. Being approved without modifications, it proceeds to presidential sanction. The commissions you will have to pass through the Chamber will be defined only after the project arrives at the House. There is no way to predict the approximate or exact time for processing, but I hope it can become law by the end of 2018.

A proposal under discussion in the Federal Government and in the National Congress tries to solve an extremely complex problem through a simplistic measure. It is the idea of combating obesity with the creation of a new tax on non-alcoholic drinks that contain sugar in their composition, such as soft drinks, juices and soft drinks.

A proposal under discussion in the Federal Government and in the National Congress tries to solve an extremely complex problem through a simplistic measure. It is the idea of combating obesity with the creation of a new tax on non-alcoholic drinks that contain sugar in their composition, such as soft drinks, juices and soft drinks.

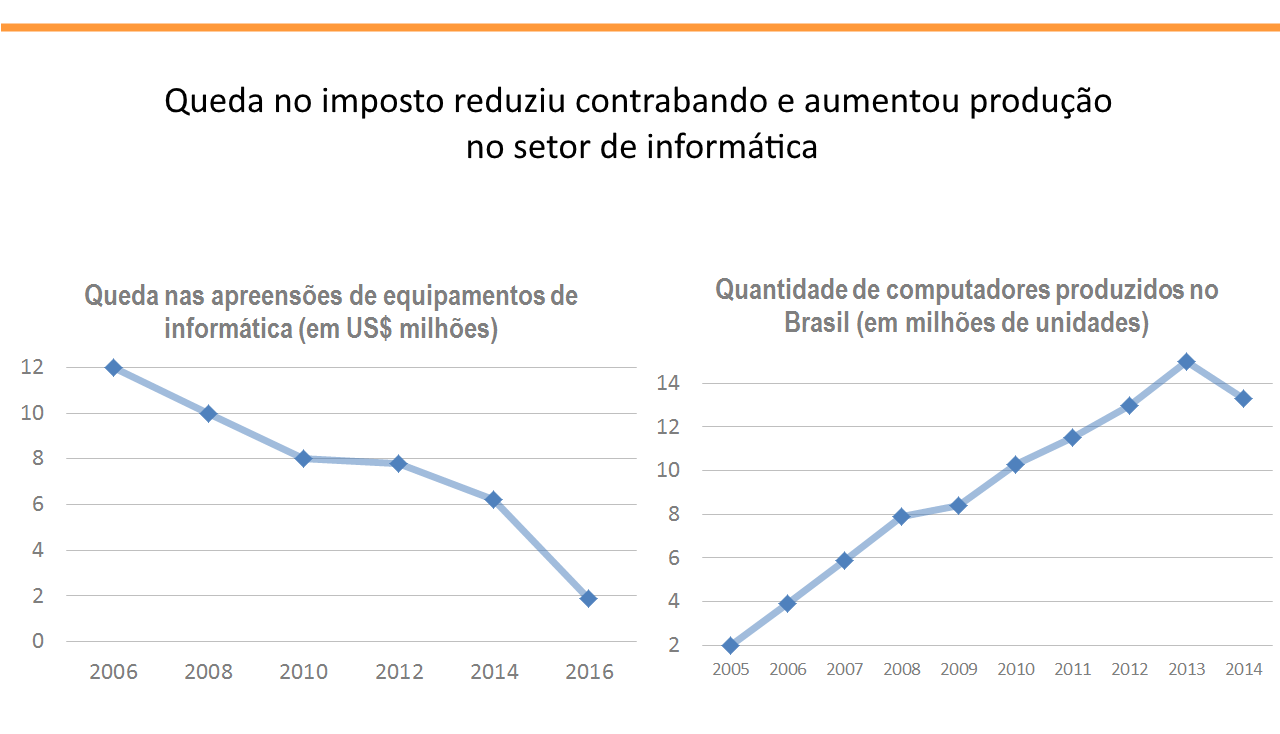

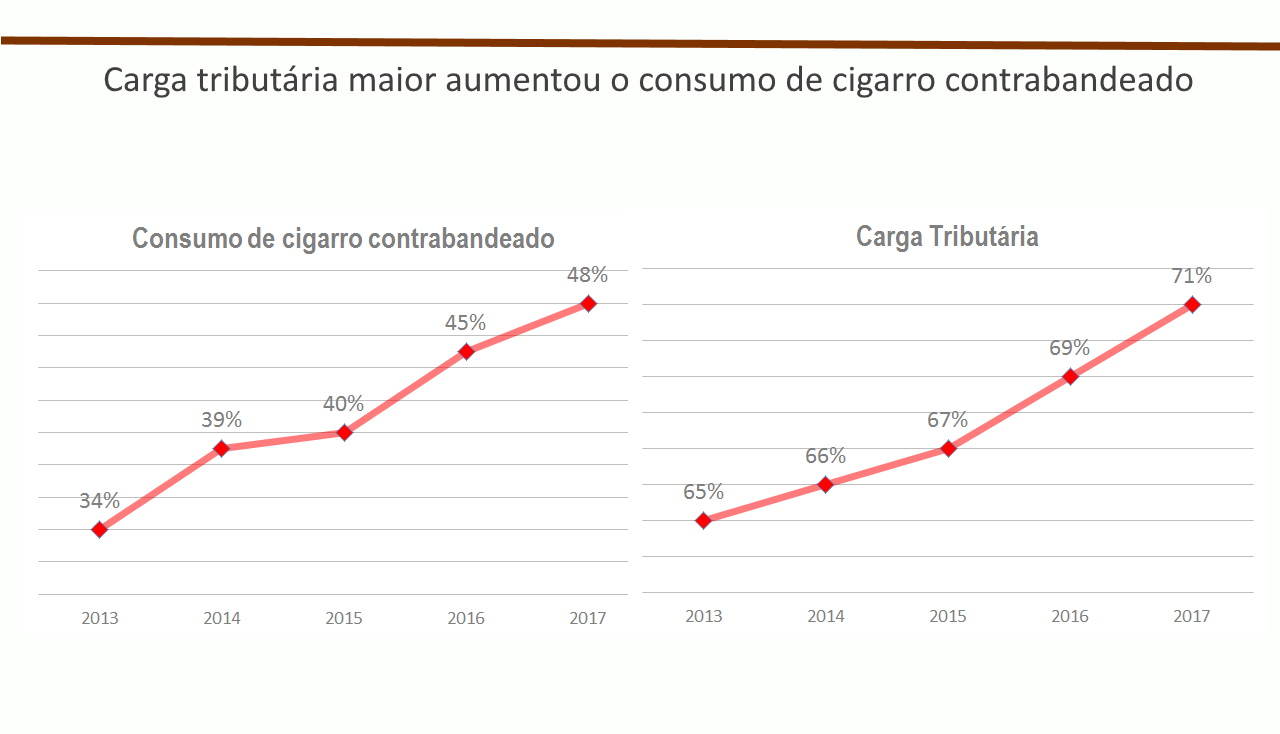

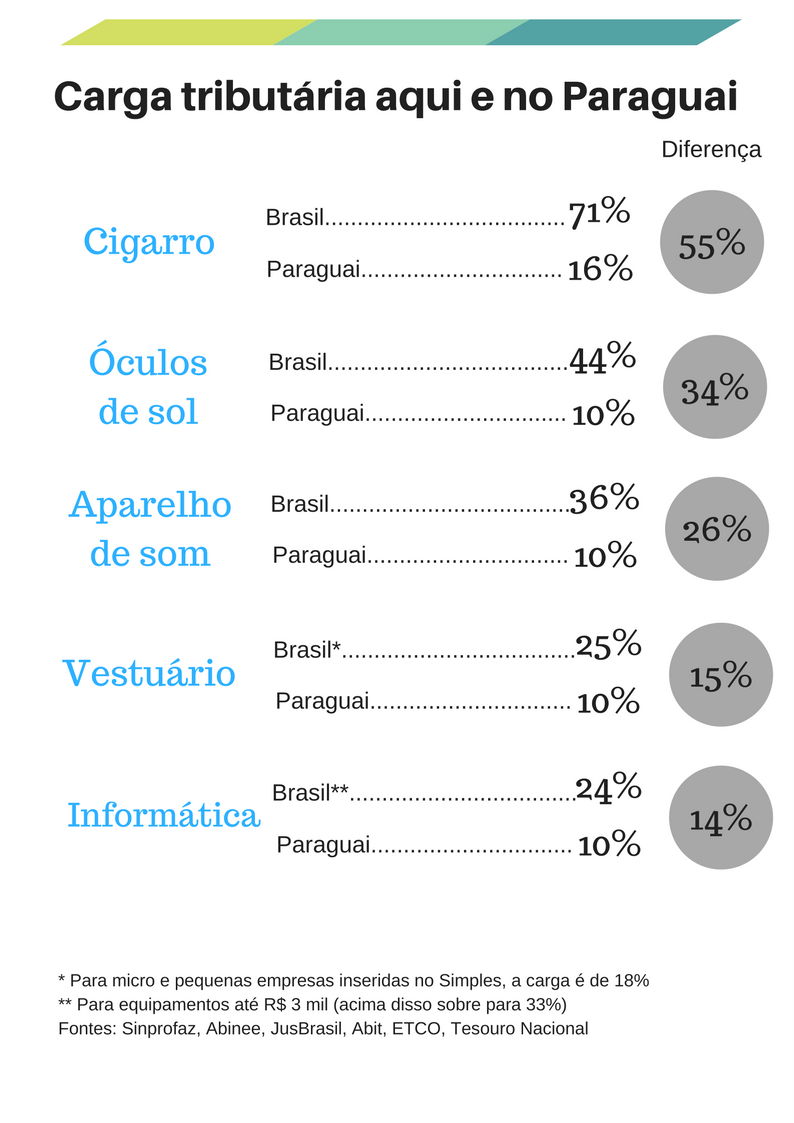

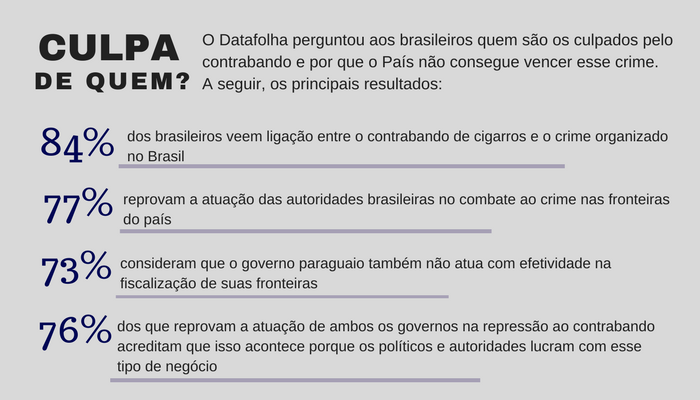

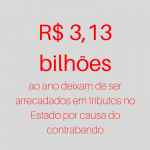

The money that the State failed to collect in 2016 would give to build 26 new hospitals or 107 new CEUs. In order to stop these losses and fight crime, the Legislative Assembly created in June the State Parliamentary Front to Combat Smuggling, led by state deputy Jorge Caruso (PMDB). “It is clear that an important part of this struggle has to be fought on Brazilian borders, as we need to close the doors for the illegal entry of products from Paraguay. But another important front of action must be combating trade in these goods in our cities ”, justifies Caruso. “This is the responsibility of state governments and city halls, which already have several mechanisms to achieve this objective, whether in the area of intelligence and repression, or tax policies that remove from smuggled products their main advantage over those manufactured legally in the country: the price . ”

The money that the State failed to collect in 2016 would give to build 26 new hospitals or 107 new CEUs. In order to stop these losses and fight crime, the Legislative Assembly created in June the State Parliamentary Front to Combat Smuggling, led by state deputy Jorge Caruso (PMDB). “It is clear that an important part of this struggle has to be fought on Brazilian borders, as we need to close the doors for the illegal entry of products from Paraguay. But another important front of action must be combating trade in these goods in our cities ”, justifies Caruso. “This is the responsibility of state governments and city halls, which already have several mechanisms to achieve this objective, whether in the area of intelligence and repression, or tax policies that remove from smuggled products their main advantage over those manufactured legally in the country: the price . ”