IRS suspends production control system that had managed to reduce tax evasion - replacement is still unknown

At the end of last year, the federal government abandoned one of the most successful physical control systems for beverage production in the world, which had managed to drastically reduce tax fraud in this segment. ETCO's executive chairman, Edson Vismona, said he was concerned about the impacts of this decision. "The previous equipment operated in 320 factories in Brazil and was decommissioned on December 13, 2016. The Revenue has publicly committed itself to developing a new system, but it is important that this is done with priority and speed," he says.

At the end of last year, the federal government abandoned one of the most successful physical control systems for beverage production in the world, which had managed to drastically reduce tax fraud in this segment. ETCO's executive chairman, Edson Vismona, said he was concerned about the impacts of this decision. "The previous equipment operated in 320 factories in Brazil and was decommissioned on December 13, 2016. The Revenue has publicly committed itself to developing a new system, but it is important that this is done with priority and speed," he says.

According to data from the Federal Revenue, the old system increased the federal tax collection on the beverage sector by 40% after its installation in 2008. There were R $ 4,5 billion more for public coffers. "It is undeniable that the absence of physical production control can open space for certain players in the beverage sector to evade taxes", warns Vismona.

History justifies this concern. Until the early 2000s, the beverage industry was the scene of many cases of companies that made tax evasion their business strategy - and that managed to grow very fast in the market. It is easy to understand why they got along so well. Drinks are a product of very high demand (over 25 billion liters per year) and tax burden

high (above 50%). A company that evades taxes is able to quickly sell all of its production by charging impractical prices for those who correctly collect taxes.

PHYSICAL CONTROL WAS THE SOLUTION

In 2003, tax evasion was estimated at 30% in the soft drink production and distribution chain and 15% in the beer chain. That year, the government started to turn the tide. First, it required companies to install flow meters on their production lines; and in 2008 the model for the adoption of the Beverage Production Control System, Sicobe, evolved, which further improved inspection. “Online, the system sent the Federal Revenue, directly from the factories, information about the manufacturer, the brand, the date of manufacture of the drink, the volume and type of packaging, thus allowing the coding of products that left the line production, ”says Vismona. Sicobe was extinguished amid the Federal Police's Sphinx operation, launched in early 2016, which raised suspicions about the bidding process that resulted in the hiring of the company responsible for implementing the system.

When it announced the end of a model before its replacement was ready, the government said it believed that another newly created mechanism could prevent tax evasion. He was referring to the implementation of the so-called Block K of SPED (Public Digital Bookkeeping System), which requires companies to send detailed data to the Revenue on all their input purchases. The system began to be used earlier this year, still in a simplified version. But the ETCO president has another opinion. "We don't believe it is enough," he says. The new physical control system being developed by Casa da Moeda provides for much more detailed monitoring of production lines, using the technology known as QR Code. But there are doubts as to the need for so much complexity, costs and implementation time. "The original schedule presented by the Casa da Moeda predicts that 100% of the beverage factories will have a new equipment installed only in March 2019", recalls the president of ETCO. "Given the relevance of this control, this period should be revised, otherwise it will be almost two years without an effective inspection mechanism, which can result in the loss of billions of reais to the public coffers."

One of ETCO's main initiatives in 2017 is the project

One of ETCO's main initiatives in 2017 is the project  Most Brazilians and many authorities are still unaware of a serious problem that has been occurring in Brazil: after a period of reduction, fraud in the fuel sector has grown again. As a result, there has been default

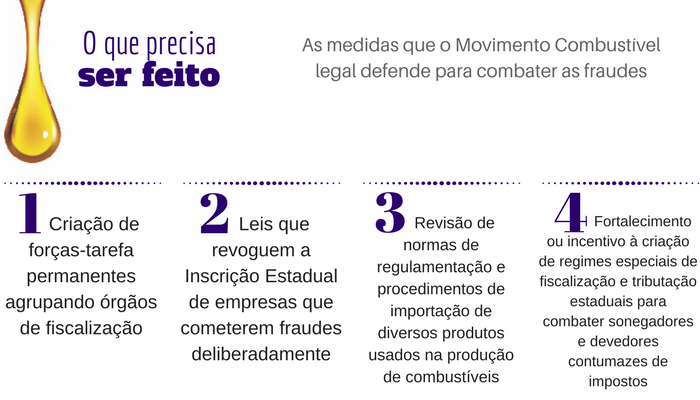

Most Brazilians and many authorities are still unaware of a serious problem that has been occurring in Brazil: after a period of reduction, fraud in the fuel sector has grown again. As a result, there has been default The director of Strategic Planning at Sindicom, Helvio Rebeschini, explains the reasons that led to the creation of the Movement. “As of the end of 2014, we noticed a deterioration in the market from a competitive point of view and the growth of new illegal practices, different from those that had occurred in the past. The disease is now different, and the old remedies no longer work ”, explains Rebeschini. “At the same time, we note that there continues to be a high degree of ignorance among the population, the media and authorities about the importance of our segment to people and the damage that these frauds cause to the country. The Legal Fuel Movement aims to raise awareness among society , join forces and implement a set of actions to curb these practices. ” Fraud is not new in this segment. They were uncommon until the early 1990s, when there was strong State control over the distribution and sale of fuels, which were priced at a fixed price. The deregulation of the sector, which on the one hand generated more competition, also started a wave of fraud from the end of the decade. At that time, one of the most serious problems was tax evasion, which subsequently evolved into a period known in the sector as the “war of injunctions”: to continue to evade, some companies entered the courts challenging the new regulatory rules and the tax laws that were being implemented by the regulatory agency and the tax authorities. Another common problem was the adulteration of

The director of Strategic Planning at Sindicom, Helvio Rebeschini, explains the reasons that led to the creation of the Movement. “As of the end of 2014, we noticed a deterioration in the market from a competitive point of view and the growth of new illegal practices, different from those that had occurred in the past. The disease is now different, and the old remedies no longer work ”, explains Rebeschini. “At the same time, we note that there continues to be a high degree of ignorance among the population, the media and authorities about the importance of our segment to people and the damage that these frauds cause to the country. The Legal Fuel Movement aims to raise awareness among society , join forces and implement a set of actions to curb these practices. ” Fraud is not new in this segment. They were uncommon until the early 1990s, when there was strong State control over the distribution and sale of fuels, which were priced at a fixed price. The deregulation of the sector, which on the one hand generated more competition, also started a wave of fraud from the end of the decade. At that time, one of the most serious problems was tax evasion, which subsequently evolved into a period known in the sector as the “war of injunctions”: to continue to evade, some companies entered the courts challenging the new regulatory rules and the tax laws that were being implemented by the regulatory agency and the tax authorities. Another common problem was the adulteration of