Taxes may increase, says Raul Velloso.

For economists, without cutting spending, the public sector will run the risk of having to raise or tax citizens more

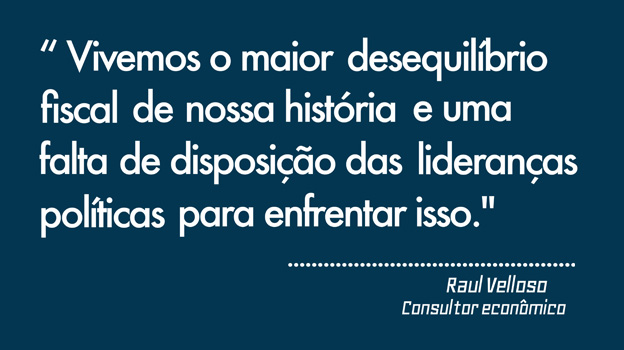

It is good that all Brazilians prepare, because the next government should be pressured to raise taxes, to balance public accounts. The alert is from the economic consultant, Raul Velloso. “It will be a disaster if that happens. But we cannot ignore that there is an economic moment to dictate things. And this economic moment shows that the country is plunged into a huge fiscal imbalance ”, he says.

In view of the difficult situation that government accounts are currently experiencing, with successive deficits since 2014, anything is possible. The prospect is that public accounts will only return to blue in 2021, at best. According to him. the debacle of the government's fiscal situation began in 2010, when the collection of the Union in relation to the Gross Domestic Product (GDP) started to fall. Revenues (before GDP) started to collapse even before the recession hit the scene. And spending continued its upward trend, ”he says.

In view of the difficult situation that government accounts are currently experiencing, with successive deficits since 2014, anything is possible. The prospect is that public accounts will only return to blue in 2021, at best. According to him. the debacle of the government's fiscal situation began in 2010, when the collection of the Union in relation to the Gross Domestic Product (GDP) started to fall. Revenues (before GDP) started to collapse even before the recession hit the scene. And spending continued its upward trend, ”he says.

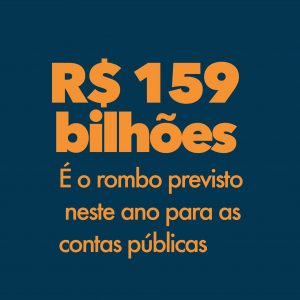

ForVelloso, the government's fiscal situation is one of the most difficult that the country has ever been through. And making use of the tax increase will be an alternative for the government that will take office next year. The gap expected in this year's accounts is R $ 159 billion. “Nobody agrees to do the other things that could be done. Today, we have the greatest fiscal imbalance in our history, and a situation with a lack of willingness on the part of political leaders to face this, on the side that has to be faced, which is the expenditure side ”, he asserts. In the economist's opinion, it is natural that, to remedy the fiscal deficit, the government brings to the table the discussion of a new round of tax increase. “The problem is that you can't move spending in Brazil. It's impressive". To try to change this situation, he summons entities, such as the Brazilian Institute of Competitive Ethics (ETCO), and society in general, which calls for a lower and better quality tax burden, “for an effort to control and reduce public spending”.

“I repeat, the fiscal imbalance is huge. There will be pressure to increase the tax burden. I cannot say at what moment, but it will certainly come in the next government, because now it is more difficult ”. states. Such a joint effort needs to involve “truly innovative solutions. The effort to improve public spending cannot wait ”, says Velloso. In his opinion, it is necessary to look forward, because if the country is simply raising old problems and not facing the question of the need to cut government spending, the bill will come the easiest way: the high tax burden.

Source: Special section Correio Braziliense, Taxation and Economic Development (14/03/2018)