Intention to reduce obesity by taxing sugary drinks is not supported by science and may contribute to increasing illegality in this market

A proposal under discussion in the Federal Government and in the National Congress tries to solve an extremely complex problem through a simplistic measure. It is the idea of combating obesity with the creation of a new tax on non-alcoholic drinks that contain sugar in their composition, such as soft drinks, juices and soft drinks.

A proposal under discussion in the Federal Government and in the National Congress tries to solve an extremely complex problem through a simplistic measure. It is the idea of combating obesity with the creation of a new tax on non-alcoholic drinks that contain sugar in their composition, such as soft drinks, juices and soft drinks.

Proponents of the proposal believe it would force consumption to drop and help stem the population's weight gain. But there are no studies in the world to confirm this theory and it finds resistance even among doctors and nutritionists. And it also counts on the opposition of business entities that see it as another attempt to increase the tax burden on the productive sector. ETCO is part of this group for an additional reason: the risk that the measure will benefit dishonest companies that make tax evasion the basis of their business. “In sectors that are already highly taxed, such as beverages, the higher the tax, the greater the risk of attracting illegality”, says the Institute's executive president, Edson Vismona. "The result is the deterioration of the competitive environment."

The concern has precedent. Until the early 2000s, the beverage market was one of the hardest hit by tax evaders. Factories that hid their sales from the tax authorities used this illicit advantage to practice artificially low prices and gain market share at the expense of serious companies. "At the time, tax evasion in the soft drink segment reached 30%," recalls Vismona.

In the following years, a more rigorous inspection of the sector, which included the installation of equipment for counting the packages filled in the beverage production lines, managed to reduce the problem. But the IRS abandoned this system at the end of 2016 to reduce expenses and the risk of tax evasion has returned. “Today, taxes are equivalent to 40% of the price the consumer pays for non-alcoholic beverages. Raising taxation even further, keeping inspection loose as it is, is folly ”, warns Vismona.

SERIOUS AND COMPLEX PROBLEM

The advance of obesity is a very serious disease that affects the whole world. According to the World Health Organization (WHO), since 1975, the rate of obese people on the planet has tripled. In Brazil, it rose from 11,8% to 18,9% only in the last ten years. Not to mention overweight Brazilians, who represent another 35% of the population. This epidemic causes enormous damage to people's health and public coffers. Diabetes, hypertension, stroke, degenerative diseases and cancer are some of the diseases related to being overweight. It is estimated that, each year, SUS (Unified Health System) spends R $ 488 million on the treatment of pathologies related to obesity.

But the problem is extremely complex. According to WHO, its roots are related to profound transformations that have occurred in the last decades. The population left the countryside for the cities; began to use means of transport and machines that reduced physical effort; many jobs today require spending the day sitting in front of the computer; sedentary lifestyle grew; the pace of life accelerated; stress and anxiety increased; more women went to work outside; it became more difficult to prepare food at home; the eating pattern has changed; and more and more people are putting on weight by consuming more calories than they spend.

To address the multiple causes of obesity, WHO has been making a series of recommendations to governments for years. There are dozens of actions that include programs to encourage sports (60 minutes a day for children and 150 minutes a week for adults); encouraging the consumption of fruits, vegetables, legumes and whole grains; educational campaigns in schools; preventive treatment in health institutions; reduced consumption of fat and sugar; changes in food labels to make their nutritional properties clearer; and other initiatives that require effort on the part of public agencies.

Last year, the organization added to this long list the suggestion to overcharge sugary drinks, a controversial idea that divides opinions around the world. This way, it became a priority. In June, the National Health Council, an agency linked to the Ministry of Health, recommended the creation of this new tax in Brazil. And a project along the same lines, authored by federal deputy Sérgio Vidigal, reached the National Congress, which held a public hearing on the theme on October 31.

INDUSTRY CONTRIBUTIONS

Leaders representing the beverage industry recognize the importance of participating in the movement to fight obesity and remember that this is already being done in the country. talked about it at the public hearing. He said that in the last six years manufacturers have reduced the amount of sugar in their products by 11% and that this reduction should reach 21% in the next four years. He also emphasized that the industry has been expanding its range of products, with the launch of drinks with different nutritional standards, including fruit juices without added sugar. And he recalled the fact that the industry as a whole decided in 2016 to stop advertising to children under 12 and that major brands, such as Coca-Cola, Ambev and Pepsico, made an additional commitment to stop selling soft drinks in schools with children that age - all through voluntary initiatives.

ABIR's president stated, however, that the industry does not accept being treated as “the main villain of obesity”, receiving discriminatory tax treatment. "A study by the research company Nielsen shows that, on average, sugary drinks represent only 4% of the daily calorie consumption of Brazilians," said Jobim. "Table sugar, the one that people add to coffee and other foods, accounts for 72% of sugar intake in the country - and is Brazil going to overcharge soft drinks?", He asked.

Data from the Federal Government itself question the relationship between the consumption of sugary drinks and the increase in obesity. According to Vigitel, a research service from the Ministry of Health that monitors lifestyle habits related to chronic diseases, in the same decade in which the obesity rate rose from 11,8% to 18,9%, regular soft drink consumption dropped from 30,9 , 16,5% for XNUMX% of the population.

The idea that increasing the tax on caloric foods may have an impact on reducing obesity also lacks scientific evidence. There are few international experiences in this regard - and the results are controversial. Proponents of the tax cite the case of Mexico, which introduced the surcharge in 2013 and recorded a 6% reduction in soft drink consumption the following year.

But the reality between the two countries in relation to this market segment is quite different. Mexico is the largest per capita consumer of soft drinks in the world. According to a study by the consultancy PwC, each Mexican drinks an average of 163 liters per year - more than double the 70 liters per capita registered in Brazil. And there, after the creation of the tax on sugary drinks, the total taxes on the product reached 28% - against the 40% that are already practiced here

REPLACEMENT BY BEER

In addition, the reduction in consumption was not accompanied by any evidence of improvement in obesity levels, which raises the hypothesis that people may have exchanged the drink for other equally caloric foods. Nutritionist Márcia Terra, director of the Brazilian Society of Food and Nutrition (SBAN), says that this possibility cannot be ruled out. She cites a study by Professor Brian Wansink, director of Cornell University's Food and Brand Laboratory (USA), which compared the behavior of two groups of American families over several months: one subject to an additional 10% fee on sugary drinks and the other is not. "In this study, there was a migration from the consumption of soft drinks to beer," says the nutritionist. In her opinion, it is necessary to better study consumer behavior to find out if such a tax has a positive, neutral or even negative effect on people's health.

MORE EFFECTIVE WAYS

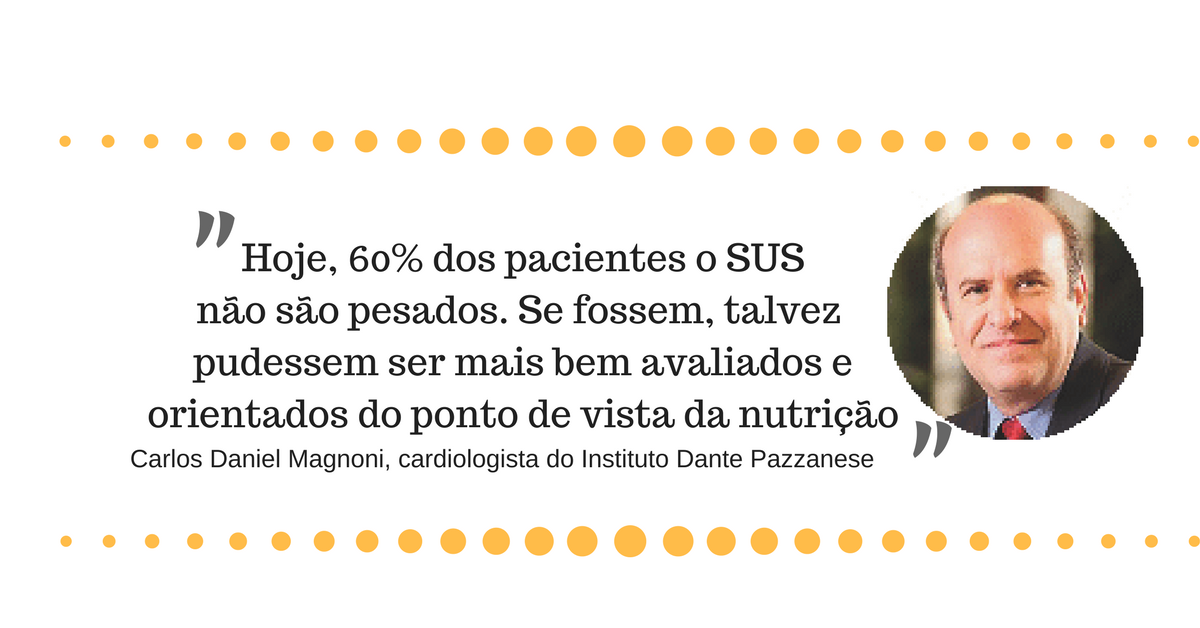

Cardiologist and nutrologist Carlos Daniel Magnoni, from the Dante Pazzanese Institute, in São Paulo, agrees. Studious of the subject and active in campaigns to fight obesity, he mentions the conclusions of the research Overcoming Obesity: An Economic Analysis, carried out by the consulting firm McKinsey. The work compared several experiences of coping with the problem and concluded that there is no scientific evidence that overcharging sugary drinks reduces people's weight.

In Magnoni's opinion, there are much more effective ways that are little explored in Brazil. An example, according to him, is a project that Dante Pazzanese applies in São Paulo and intends to spread across the country called Obesity Zero. The goal is to direct more people to the nutritional guidance service and part of a simple action: measure the weight and height of all patients who arrive at the hospital, regardless of the reason. "Today, 60% of SUS patients are not heavy," he laments. "If they were, perhaps they could be better evaluated and guided from the point of view of nutrition."

Another doctor who does not believe in the effectiveness of the surcharge is professor of pediatrics Hugo da Costa Ribeiro Júnior, from the Faculty of Medicine of the Federal University of Bahia (UFBA), a specialist in childhood obesity. According to him, scientific studies confirm that being overweight is related to multiple factors, including the type of delivery, breastfeeding, food in the first thousand days, the habit of having breakfast. "All measures that disregard this complexity and seek the simplest solutions do not work and are not sustainable in the medium and long term," he says. "It is a mistake to focus on the management of specific foods: this does not educate and does not benefit from the point of view of setting up an adequate diet."

If there is no evidence that overcharging sugary drinks reduces obesity, the same cannot be said about its effects on the competitive environment. The example comes from Denmark, one of the most developed nations in the world that was also one of the first to institute a specific tax on sugary drinks, in 1930. The tax was in force for 83 years. During this period, the Danes paid the equivalent of R $ 0,85 in additional tax per liter of soft drink. In 2013, the surcharge was abolished - among other reasons, by stimulating the illegal beverage trade from neighboring Sweden and Germany, exempt from the tax. There, research shows that more than eight decades of tax to discourage soft drink consumption has only favored smuggling.