by: Valentina Trevor

According to FGV, tax evasion in the fuel sector reaches R $ 4,8 billion per year.

Fuels, cigarettes and beverages are products that have a high tax burden in Brazil, reaching 50% of the final price.

From a competitive point of view, if all producers, distributors, resellers respected the law and worked legally, the market would remain balanced. However, the high tax burden opens up possibilities for tax evasion, which harms the market as a whole, creating a competitive distortion.

In the fuel sector alone, the states stopped collecting, in 2016, about R $ 4,8 billion in taxes, according to a study by the Getúlio Vargas Foundation (FGV) in July 2017. This figure represents only part of the taxes that are not paid to public coffers, related to ICMS.

That businessman who does not pay due taxes has a much greater margin to work, highlights Edson Vismona, Executive President of ETCO - Brazilian Institute of Ethics in Competition. According to him, there are companies structured to not pay taxes, which “push non-payment” and obtain disproportionate advantages in relation to the competition.

Ronaldo Redenschi and Julio Janolio, partners of the firm Vinhas e Redenschi Advogados also call attention to the judicial issue. With a fragmented judiciary, in a highly taxed sector such as fuel, what we see are “injunctions and injunctions that have a devastating effect on competition”, they say.

“The company that operates with an injunction has advantages over the competition by not paying the same taxes. And with the recent increases in state ICMS and PIS / Cofins by the federal government, this has become an almost daily problem, ”says Janolio.

From the point of view of the formal market, there is a concern to have respected free competition, which, according to him, does not happen with those persistent debtors, informal companies and those that operate with injunctions.

For Paulo Furquim de Azevedo, Coordinator of the Business Studies Center at Insper, “the actor most affected in this 'game' is the small businessman who wants to formalize himself. He competes directly with the one who evades ”.

The small distributor that wants to play the game honestly and wants to grow in the market is going to have a huge difficulty. It cannot put the price too low, because the tax burden is high. If a price similar to that offered by large distributors is placed, the consumer thinks it is expensive and supplies in the known. "If you do not have a consolidated brand, it is difficult to enter the market", highlights Furquim.

In addition, in the fuel sector, there is the issue of adulteration. This is perhaps an even more serious problem.

“This is a market where the consumer is not very aware of the product he buys. He gives preference to the brand that conveys more confidence. He pays for trust, even if he has to pay more for the same product, ”says Furquim.

Francisco Neves, Supply Supervision Superintendent of the National Oil and Gas Agency (ANP) highlights the importance of the consumer having an active and attentive attitude to the consumption environment. For him, it is important to know better the product he will acquire, the commercial rules, how to activate the control organs.

“Price is not the only factor that should be taken into account by the consumer. He must pay attention to the origin of the product, seek authorization for operation, see if the pumps have an Inmetro seal, request the invoice. All of this is part of the commercial relationship and brings security to the consumer. ”

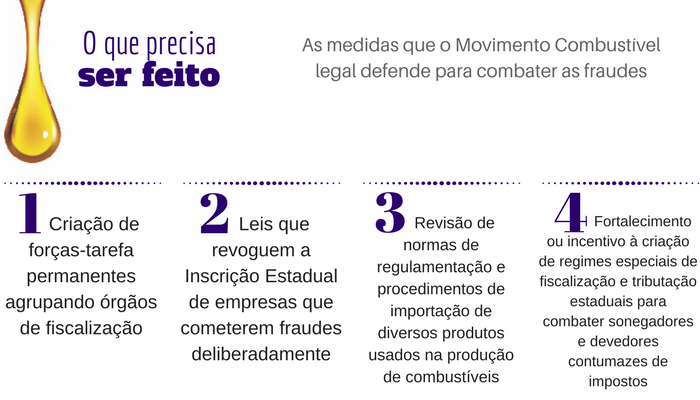

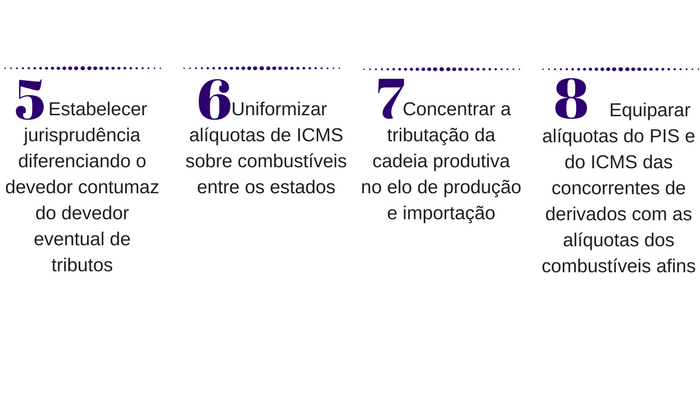

In addition to the constant inspection by the ANP, other important actions that have been taken in order to avoid tax evasion and maintain a more competitive market, such as state laws to remove state registrations from irregular companies, the bill in progress in Congress to combat the stubborn debtor etc.

Source: Portal Jota (15/09)

The tax compliance programs developed by the government to tighten up enforcement against taxpayers with a higher risk of tax evasion mainly affect economic sectors that suffer a higher incidence of taxes. Entities point out that in the sectors of fuels, cigarettes and beverages, for example, there are companies that fail to pay taxes as a business strategy to artificially lower prices and compete for consumer preference unfairly. In addition to the tax benefits, concentrating enforcement on incumbent debtors would also improve competition in the market.

The tax compliance programs developed by the government to tighten up enforcement against taxpayers with a higher risk of tax evasion mainly affect economic sectors that suffer a higher incidence of taxes. Entities point out that in the sectors of fuels, cigarettes and beverages, for example, there are companies that fail to pay taxes as a business strategy to artificially lower prices and compete for consumer preference unfairly. In addition to the tax benefits, concentrating enforcement on incumbent debtors would also improve competition in the market.

The Finance Secretariat opened a public consultation in order to improve the functioning of the

The Finance Secretariat opened a public consultation in order to improve the functioning of the

Most Brazilians and many authorities are still unaware of a serious problem that has been occurring in Brazil: after a period of reduction, fraud in the fuel sector has grown again. As a result, there has been default

Most Brazilians and many authorities are still unaware of a serious problem that has been occurring in Brazil: after a period of reduction, fraud in the fuel sector has grown again. As a result, there has been default The director of Strategic Planning at Sindicom, Helvio Rebeschini, explains the reasons that led to the creation of the Movement. “As of the end of 2014, we noticed a deterioration in the market from a competitive point of view and the growth of new illegal practices, different from those that had occurred in the past. The disease is now different, and the old remedies no longer work ”, explains Rebeschini. “At the same time, we note that there continues to be a high degree of ignorance among the population, the media and authorities about the importance of our segment to people and the damage that these frauds cause to the country. The Legal Fuel Movement aims to raise awareness among society , join forces and implement a set of actions to curb these practices. ” Fraud is not new in this segment. They were uncommon until the early 1990s, when there was strong State control over the distribution and sale of fuels, which were priced at a fixed price. The deregulation of the sector, which on the one hand generated more competition, also started a wave of fraud from the end of the decade. At that time, one of the most serious problems was tax evasion, which subsequently evolved into a period known in the sector as the “war of injunctions”: to continue to evade, some companies entered the courts challenging the new regulatory rules and the tax laws that were being implemented by the regulatory agency and the tax authorities. Another common problem was the adulteration of

The director of Strategic Planning at Sindicom, Helvio Rebeschini, explains the reasons that led to the creation of the Movement. “As of the end of 2014, we noticed a deterioration in the market from a competitive point of view and the growth of new illegal practices, different from those that had occurred in the past. The disease is now different, and the old remedies no longer work ”, explains Rebeschini. “At the same time, we note that there continues to be a high degree of ignorance among the population, the media and authorities about the importance of our segment to people and the damage that these frauds cause to the country. The Legal Fuel Movement aims to raise awareness among society , join forces and implement a set of actions to curb these practices. ” Fraud is not new in this segment. They were uncommon until the early 1990s, when there was strong State control over the distribution and sale of fuels, which were priced at a fixed price. The deregulation of the sector, which on the one hand generated more competition, also started a wave of fraud from the end of the decade. At that time, one of the most serious problems was tax evasion, which subsequently evolved into a period known in the sector as the “war of injunctions”: to continue to evade, some companies entered the courts challenging the new regulatory rules and the tax laws that were being implemented by the regulatory agency and the tax authorities. Another common problem was the adulteration of