Initiative supported by ETCO seeks to mobilize society against increasing fraud in the sale of gasoline, alcohol and diesel

Most Brazilians and many authorities are still unaware of a serious problem that has been occurring in Brazil: after a period of reduction, fraud in the fuel sector has grown again. As a result, there has been default

Most Brazilians and many authorities are still unaware of a serious problem that has been occurring in Brazil: after a period of reduction, fraud in the fuel sector has grown again. As a result, there has been default

in the payment of taxes, higher incidence of selling stolen cargo, product adulteration, with a mixture of cheaper substances and with lower taxation, and also fraud in the meters of the supply pumps - the so-called low pump. These practices degrade the competitive environment and harm everyone: consumers, honest businessmen, the state that fails to collect taxes and the population that depends on services financed by taxes, such as education, health and security.

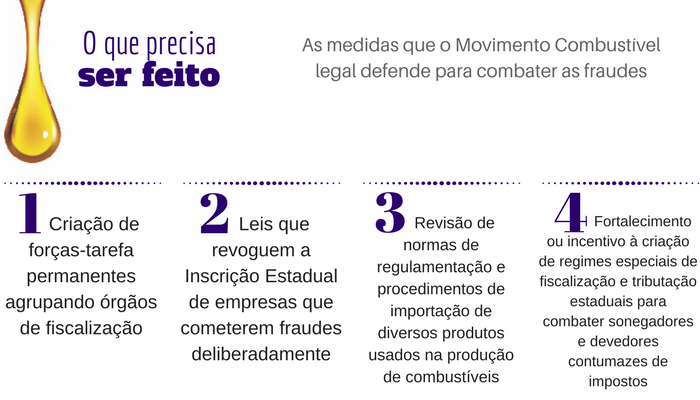

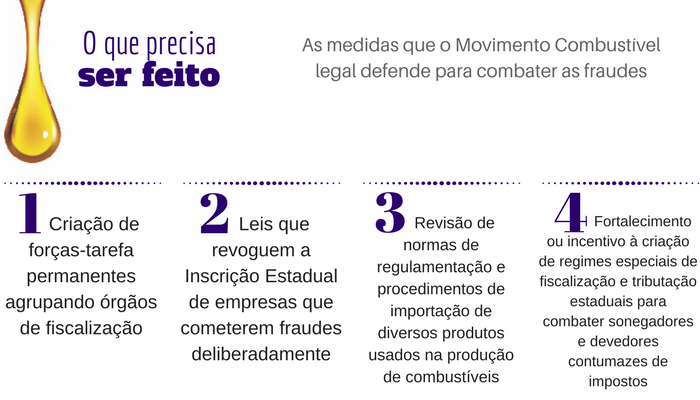

Alerting the population about the existence and growth of these problems and joining forces to combat them is the purpose of an action supported by ETCO and led by the National Union of Fuel and Lubricant Distribution Companies (Sindicom). This is the Legal Fuel Movement, which started to be prepared in November 2016 and was officially launched in August 2017. “This sector is very affected by unfair practices”, says ETCO's executive president, Edson Vismona. "In addition to the impacts of the economic crisis, the right companies suffer from having to compete in such a price-sensitive market with dishonest competitors who resort to the most varied illicit devices to sell cheaper."

In the last few years, cases of fuel adulteration, cargo theft and low pump have been increasing, which harm honest competitors, consumers and the country as a whole.

A NEW DISEASE

The director of Strategic Planning at Sindicom, Helvio Rebeschini, explains the reasons that led to the creation of the Movement. “As of the end of 2014, we noticed a deterioration in the market from a competitive point of view and the growth of new illegal practices, different from those that had occurred in the past. The disease is now different, and the old remedies no longer work ”, explains Rebeschini. “At the same time, we note that there continues to be a high degree of ignorance among the population, the media and authorities about the importance of our segment to people and the damage that these frauds cause to the country. The Legal Fuel Movement aims to raise awareness among society , join forces and implement a set of actions to curb these practices. ” Fraud is not new in this segment. They were uncommon until the early 1990s, when there was strong State control over the distribution and sale of fuels, which were priced at a fixed price. The deregulation of the sector, which on the one hand generated more competition, also started a wave of fraud from the end of the decade. At that time, one of the most serious problems was tax evasion, which subsequently evolved into a period known in the sector as the “war of injunctions”: to continue to evade, some companies entered the courts challenging the new regulatory rules and the tax laws that were being implemented by the regulatory agency and the tax authorities. Another common problem was the adulteration of

The director of Strategic Planning at Sindicom, Helvio Rebeschini, explains the reasons that led to the creation of the Movement. “As of the end of 2014, we noticed a deterioration in the market from a competitive point of view and the growth of new illegal practices, different from those that had occurred in the past. The disease is now different, and the old remedies no longer work ”, explains Rebeschini. “At the same time, we note that there continues to be a high degree of ignorance among the population, the media and authorities about the importance of our segment to people and the damage that these frauds cause to the country. The Legal Fuel Movement aims to raise awareness among society , join forces and implement a set of actions to curb these practices. ” Fraud is not new in this segment. They were uncommon until the early 1990s, when there was strong State control over the distribution and sale of fuels, which were priced at a fixed price. The deregulation of the sector, which on the one hand generated more competition, also started a wave of fraud from the end of the decade. At that time, one of the most serious problems was tax evasion, which subsequently evolved into a period known in the sector as the “war of injunctions”: to continue to evade, some companies entered the courts challenging the new regulatory rules and the tax laws that were being implemented by the regulatory agency and the tax authorities. Another common problem was the adulteration of

fuels with a mixture of less taxed and therefore cheaper products, which made selling prices artificially

minors.

THE REASONS FOR IMPROVEMENT

Initiatives that had the support of ETCO and Sindicom managed to revert this situation around 2005. Rebeschini cites, among the most effective, the adoption of tax substitution in the sector, which started to concentrate tax collection in the first link of the production chain. , represented by fuel producers and importers. Another important instrument, according to

the president of ETCO, was the implementation of the Electronic Invoice, whose development had the effective participation of the Institute.

“This was one of the greatest advances in combating tax evasion in all segments,” says Vismona.

The battle against adulteration included actions such as mandatory orange coloring of anhydrous ethanol, a type that is mixed with gasoline, and the adoption of tougher laws against criminals. In São Paulo, for example, since 2006 companies accused of adulteration are subject to the loss of state registration.

CASCADE EFFECT

“Fraud never ceased to exist, but between 2005 and 2013 they were more or less controlled”, recalls the director of Sindicom. The deterioration seen in recent years has a number of reasons. “In part, it has to do with the economic recession, with impacts on demand and cost pressure. This ended up putting pressure on companies and taking some of them to illegality ”, says Rebeschini. “And the fiscal crisis also caused restrictions on the public budget and ended up weakening the inspection bodies. "

But the main factor was the emergence of the figure of the persistent tax debtor, a phenomenon that began to be observed in 2010, but became more acute in the following years. This is a new form of judicial battle, now no longer in search of injunctions to allow tax evasion, but to sustain deliberate tax defaults. “The fraudster realized that owing taxes, even on purpose and for long periods, does not cause him very serious problems. He knows that if he adulterates or evades, he is criminalized, so he adopted the motto 'I must, I don't deny it and I don't pay'. Usually, they are companies without equity, partners that are not always true and that have nothing to lose ”, explains the director of Sindicom. These companies rely on the slowness of administrative and justice processes and the lack of updating of the legislation that differentiates the eventual debtor of taxes from the defaulting debtor, who does

that practice your business strategy. The remedy to combat this new evil involves the regulation of a constitutional provision that allows different treatment against such taxpayers (*). According to Rebeschini, the incumbent debtor ends up triggering other frauds. “It's a ripple effect or a wave effect. A gas station buys fuel from a distributor that pays no taxes and reduces its prices. Its neighboring competitors, in order not to lose customers, give up their profitability for as long as they can take it, from then on they close their doors or sell the business to a fraudulent competitor or end up going to irregular trade. The unscrupulous enter the business of stolen cargo, adulteration of fuel, "low pump" and so on, "he observes.

In addition to harming consumers and honest competitors, these frauds divert billions from public coffers. Together, ICMS evasion and defaults produce an annual loss of R $ 4,8 billion, according to a study by the Getúlio Vargas Foundation. Money that could be used to build or improve hospitals, schools, security and other public services.

The Finance Secretariat opened a public consultation in order to improve the functioning of the Conformes program, created by Complementary Law No. 1.320 / 2018, which establishes a new logic of action for the state tax authorities: support and collaboration for the taxpayer in gradually replacing the model focused on the merely punitive model.

The Finance Secretariat opened a public consultation in order to improve the functioning of the Conformes program, created by Complementary Law No. 1.320 / 2018, which establishes a new logic of action for the state tax authorities: support and collaboration for the taxpayer in gradually replacing the model focused on the merely punitive model.

Most Brazilians and many authorities are still unaware of a serious problem that has been occurring in Brazil: after a period of reduction, fraud in the fuel sector has grown again. As a result, there has been default

Most Brazilians and many authorities are still unaware of a serious problem that has been occurring in Brazil: after a period of reduction, fraud in the fuel sector has grown again. As a result, there has been default The director of Strategic Planning at Sindicom, Helvio Rebeschini, explains the reasons that led to the creation of the Movement. “As of the end of 2014, we noticed a deterioration in the market from a competitive point of view and the growth of new illegal practices, different from those that had occurred in the past. The disease is now different, and the old remedies no longer work ”, explains Rebeschini. “At the same time, we note that there continues to be a high degree of ignorance among the population, the media and authorities about the importance of our segment to people and the damage that these frauds cause to the country. The Legal Fuel Movement aims to raise awareness among society , join forces and implement a set of actions to curb these practices. ” Fraud is not new in this segment. They were uncommon until the early 1990s, when there was strong State control over the distribution and sale of fuels, which were priced at a fixed price. The deregulation of the sector, which on the one hand generated more competition, also started a wave of fraud from the end of the decade. At that time, one of the most serious problems was tax evasion, which subsequently evolved into a period known in the sector as the “war of injunctions”: to continue to evade, some companies entered the courts challenging the new regulatory rules and the tax laws that were being implemented by the regulatory agency and the tax authorities. Another common problem was the adulteration of

The director of Strategic Planning at Sindicom, Helvio Rebeschini, explains the reasons that led to the creation of the Movement. “As of the end of 2014, we noticed a deterioration in the market from a competitive point of view and the growth of new illegal practices, different from those that had occurred in the past. The disease is now different, and the old remedies no longer work ”, explains Rebeschini. “At the same time, we note that there continues to be a high degree of ignorance among the population, the media and authorities about the importance of our segment to people and the damage that these frauds cause to the country. The Legal Fuel Movement aims to raise awareness among society , join forces and implement a set of actions to curb these practices. ” Fraud is not new in this segment. They were uncommon until the early 1990s, when there was strong State control over the distribution and sale of fuels, which were priced at a fixed price. The deregulation of the sector, which on the one hand generated more competition, also started a wave of fraud from the end of the decade. At that time, one of the most serious problems was tax evasion, which subsequently evolved into a period known in the sector as the “war of injunctions”: to continue to evade, some companies entered the courts challenging the new regulatory rules and the tax laws that were being implemented by the regulatory agency and the tax authorities. Another common problem was the adulteration of