Smuggling caused a loss of R $ 115 billion to Brazil in 2015. The volume is 15% higher than in the previous year. The calculation includes extinct jobs and loss of competitiveness. The balance is of the Association to Combat the Illegal Market (ACMI) that, to mark the National Day to Combat Smuggling, made today (3) demonstrations in Brasília, Rio, São Paulo, Foz do Iguaçu and Porto Alegre, demanding immediate actions from the federal government to prevent the entry of contraband products.

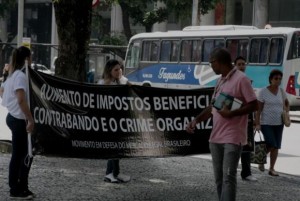

In Rio de Janeiro, the act took place on the corner of Rio Branco and Presidente Vargas avenues, next to the Candelária Church, in the city center. “The movement in Rio was very positive, bringing good results. We hope to have achieved our objective, both in the governmental and social aspects ”, said ACMI director, Roberto Lima.

In Brasília, the demonstration was organized by the National Movement for the Defense of the Brazilian Legal Market, with the participation of the Brazilian Institute of Competitive Ethics (Etco) and the National Forum Against Piracy and Illegality (FNCP), in addition to 70 business entities and organizations civil society.

A survey by the Datafolha Institute on smuggling in Brazil, carried out between 23 and 25 February this year, with 2.056 people heard in 130 small, medium and large cities, metropolitan regions and cities in the interior of the country, showed what the Brazilian thinks about smuggling and the government's lack of action to fight crime.

At work, Datafolha indicated some phrases. In the phrase “contraband products bring harm to Brazil and its industry”, according to the survey, 76% totally agree and 13% partially, 2% neither agree nor disagree and 7% disagree with the sentence, 5% totally disagree and 3% in part. They did not know how to answer 1%. When the phrase was “smuggled products encourage organized crime and the trafficking of drugs and arms”, 77% followed it completely and 11% in part, 1% did not part. They did not give a 9% opinion.

Roberto Lima defended the reinforcement of the actions of combat in the borders and the reduction of the taxes of products that suffer more contraband action, to make them cheaper, and less attractive for this type of crime.

“From my point of view, the most important measure is the effective work at the borders, in order to reduce the entry of these products in Brazil. Another measure is the existence of a sensible tax policy for companies that operate in the Brazilian legal market. The government has the false impression that if it increases the tax, it increases the collection, when it does not, in fact. It increases the tax and reduces the shift, because it encourages the entry of smuggling, ”he said.

For Roberto Lima, if there was a tax reduction, the effects would be felt in the short term. “If a project were made to reduce taxation, so that products would have lower and more accessible prices, certainly the sales and collection volume would increase, because companies are the ones who contribute to this. With illegality, nothing is collected, ”he said.

The director informed that cigarette smuggling is at the top of the list of products that entered Brazil illegally in 2015. Also on the list are appliances, clothing, glasses, computer items, watches, medicines and toys for babies, which can bring health problems to children, for containing chemicals. “Of the R $ 115 billion, there is R $ 702 million with cigarettes alone. They enter through Mato Grosso do Sul. They are cigarettes manufactured in Paraguay ”, he revealed.

According to Lima, the damage to the country has increased in recent years. In 2010, the estimate was R $ 80 billion. “Since then it has been growing, reaching R $ 115 billion in 2015, and from 2014 to 2015 it increased by 15%”.

Protest in Brasilia

In Brasília, the 150 or so protesters criticized, in front of the Planalto Palace, also for the excess of taxes collected by the Public Power.

“We are here to say that smugglers have a lot to thank the government, which does not invest the necessary investments to combat this practice. The Federal Police and the IRS are barely able to control the borders, which harms, in terms of competitiveness, the national industry. At the same time, they impose excessive taxes on the sectors we represent ”, said the president of the National Forum Against Piracy and Illegality (FNCP), Edson Vismona.

The report sought the IRS to comment on the statements, but did not receive a response until the text was published.

Source: Agência Brasil (3/03)