Brazil has become a breeding ground for smuggling and arms and drug trafficking. Combating such illicit activities involves simplifying taxes

The country has become a fertile market for smuggled and pirated products. Not by chance, it has become the largest global market for illegal Roma. The cigarette of our neighbor, Paraguay, already occupies 48% of the entire national market, a record number that brings enormous damage to the Brazilian economy.

The problem is aggravated because this crime does not come alone. It harms local commerce and industry, reduces tax collection and jobs, increases health risks and encourages organized crime and drug and arms trafficking. Facing the problem requires a tax review so that the sectors, heavily taxed, and which suffer a great impact from smuggling, can remain standing.

The imbalance in regional taxation is evident in the sectors most affected by smuggling and piracy, such as fuel and tobacco. While the tax burden on cigarettes is 16% in Paraguay, the lowest in the world, Brazil, Argentina and Chile charge 70% to 80%.

“The whole world argues that it is necessary to have a higher tax on cigarettes in order to fight consumption. Paraguay ignores this. Hence the regional imbalance. We are encouraging smuggling. The suggestion presented in the last convention of the World Trade Organization (WTO) is the equalization of taxes between Brazil and Paraguay, since the current difference stimulates illicit trade ”, says Edson Vismona, executive president of the Brazilian Institute of Ethics in Competition (ETCO) and the National Forum Against Piracy and Illegality (FNCP).

He explains that the survival of Brazilian companies depends on the effective fight against fraud, such as tax evasion, smuggling, embezzlement and under-invoicing. “We are absolutely convergent. If we didn't have that in mind, these companies just don't survive ”, he laments. For Vismona, everyone loses with tax evasion, because billions of reais are subtracted from the treasury. The country's competitiveness decreases, since companies that pay taxes have to compete with those that pay nothing.

”It is impossible to compete. We suffer this in several situations, we have a weight to push and the others, free and loose, gain market share, but not due to competitiveness, and the country loses by reducing productive investments ”, he points out. The persistent debtor also worries ETCO. According to Vismona, Brazil is experiencing a unique situation, in which entrepreneurs, from all sectors, who are nothing more than bandits, settle in the market, already with the intention of not paying tax. The business of these entrepreneurs includes postponing, as much as possible, the settlement with the tax authorities, leaving the damage to the treasury and the taxpayers.

Only in the fuel sector, Vismona estimates that the loss reaches R $ 2 billion per year. “In the case of cigarettes, over a wider period, R $ 17 billion is irrecoverable. When the Revenue goes after, the company has already closed or changed its CNPJ, warns. There is no more room for the leitinho ”Competitive ethics and the defense of legality are foundations of coexistence, and encourage the development of any country, according to the executive president of the Brazilian Institute of Ethics in Competition (ETCO) and the National Forum Against Piracy and Illegality (FNCP), Edson Vismona.

For him, when analyzing the situation of the richest countries by the Human Development Index (HDI), it can be seen that respect for ethics, the fight against corruption and the defense of the Law guide these nations.

“If we don't have the ethical question raised, and the defense of the law as something absolutely central to our activity, we will always be left behind. And we will get nowhere. This is the basis and foundation for creating a developed country ”, he says. Respect for ethics and defense of the law should guide the debates of candidates for next October's elections, throughout Brazil. In making this defense, Vismona says that debates on taxation and economic development are “absolutely important, in the process of discussing our destiny and what we want for the country”.

“The moment is very important. Brazil needs to take a definitive turn. We are absolutely tired of, at each moment, having a period of growth and then plunging into a situation of recession, the so-called chicken flight. We don't deserve this, ”says the ETCO president.

Integrity

Vismona welcomes contributions that can raise the debate on important issues in Brazil, such as taxation and security, and that will guide, in a more concrete and consistent way, the country's future. The executive says that simplification is the magic word for the Brazilian tax system. It also emphasizes that businessmen have to respect ethical attitudes, too, since this type of positioning is a stimulus to the development of any nation.

The tax, according to the executive, is a weight chained to the feet of Brazilians. And dragging this iron ball needs to be lighter for taxpayers. “We need to provide conditions for competitiveness, expand competition and make everyone respect the same rules. This is the main content of the actions in which we are involved. We want to strengthen this sense of construction and respect for a country that makes us proud to participate, ”he says.

Founded in 2003,0 ETCO promotes integrity in the business environment. The Institute defends the fulfillment of tax obligations by all and the simplification of the tax system, in order to make it more transparent and less costly to all taxpayers, in general.

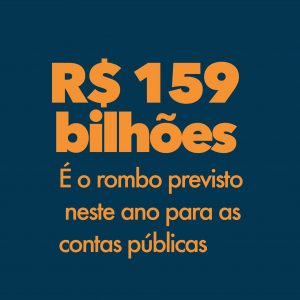

In view of the difficult situation that government accounts are currently experiencing, with successive deficits since 2014, anything is possible. The prospect is that public accounts will only return to blue in 2021, at best. According to him. the debacle of the government's fiscal situation began in 2010, when the collection of the Union in relation to the Gross Domestic Product (GDP) started to fall. Revenues (before GDP) started to collapse even before the recession hit the scene. And spending continued its upward trend, ”he says.

In view of the difficult situation that government accounts are currently experiencing, with successive deficits since 2014, anything is possible. The prospect is that public accounts will only return to blue in 2021, at best. According to him. the debacle of the government's fiscal situation began in 2010, when the collection of the Union in relation to the Gross Domestic Product (GDP) started to fall. Revenues (before GDP) started to collapse even before the recession hit the scene. And spending continued its upward trend, ”he says.

He stressed that it is necessary to eliminate deficiencies, anomalies and distortions in the Brazilian tax system. "The current situation has a negative evaluation, no doubt," he guaranteed. "The proliferation of subsystems and regimes fragments the tax system".

He stressed that it is necessary to eliminate deficiencies, anomalies and distortions in the Brazilian tax system. "The current situation has a negative evaluation, no doubt," he guaranteed. "The proliferation of subsystems and regimes fragments the tax system".

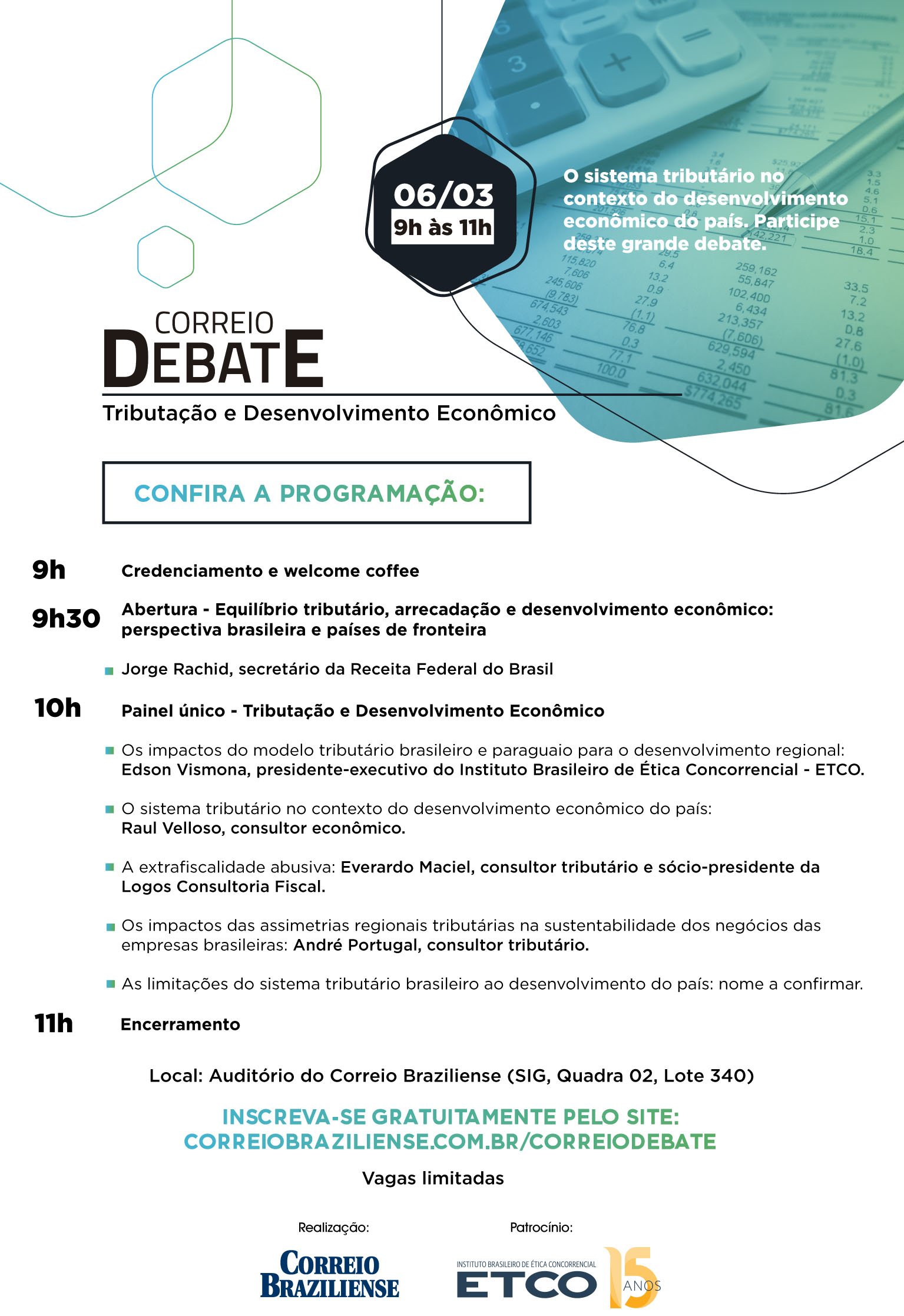

http://www.correiobraziliense.com.br/correiodebate/tributacao/

http://www.correiobraziliense.com.br/correiodebate/tributacao/