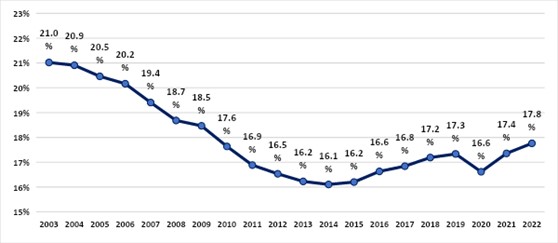

The underground economy increased its participation in the Brazilian economy and reached 17,8% of the GDP, which represents approximately R$ 1,7 trillion reais. The result is part of Underground Economy Index (HEI), a partnership between the Brazilian Institute of Ethics in Competition (ETCO) and FGV/IBRE, which since 2003 has followed the evolution of activities that operate outside the laws and regulations that affect formal activities in the country.

The indicator, higher than that observed in 2021 (17,4%), points to a return to the pattern of increases caused by the events of recent years associated with the covid-19 pandemic, which raised the level of uncertainty in relation to the performance of the economy.

The end of the most acute phase of the pandemic and the beginning of the process of normalization of economic activity favored a faster recovery of informal employment, which reacts more quickly, contributing to the increase in the Underground Economy Index (IES) 2021 the year.

According to Edson Vismona, president of ETCO, this increase in the IES points to the new government the need to strengthen the economic fundamentals, with a tax reform that stimulates the formalization of the economy and the generation of jobs.

Making a historical rescue, the increases observed in the indicator until the year 2019 were a consequence of the crisis that started in mid-2014, which reduced the formal sector of the economy. At the same time, the reduction in interest rates and the slow increase in economic activity softened the shadow economy's growth scenario, which would be stronger in the absence of these factors.

The Graph shows the evolution of the Underground Economy Index since 2003 - Source: Prepared by ETCO and FGV / IBRE

FGV/IBRE economist Fernando de Holanda Barbosa Filho points out that the last few years associated with the COVID-19 pandemic crisis have disproportionately affected informal workers compared to formal workers.

“Because it is more flexible, it is very likely that employment will recover, as we have already seen, due to stronger increases in the informal labor market, which may lead to further increases in the shadow economy indicator in the coming years. . Therefore, the dynamics of the indicator will depend on the speed of recovery of the economy, which will depend on the progress of the reforms necessary to stimulate the economy”, concludes Barbosa Filho.

Vismona and Barbosa Filho agree that the structural factors that led to the reduction of the shadow economy remain present in the Brazilian economy, but caution is needed in assessing the evolution of the indicator, as its dynamics will depend on the speed of economic recovery, which will depend on the progress of reforms needed to stimulate the economy.

Evolution of the Index

ETCO and FGV/IBRE developed a index for monitoring shadow economy providing an indicator of the evolution of informal activities. Shadow economy is defined as the production of goods and services not reported to the government, deliberately, to evade taxes; evading social security contributions; circumvent compliance with labor laws and regulations; avoid costs arising from the rules applicable to each activity.

The index starts in 2003, with the highest value of the historical series, about 21% of the Brazilian GDP and since then, it has shown a strong downward trend, reaching its lowest value in 2014 (16,1%). However, from 2015 onwards, the indicator worsened, with an increase of more than 1 percentage point between 2015 and 2019.

The reduction in the index in the country in the 2000s is related to several structural factors that stimulated the formalization of the labor market and made it difficult for companies to operate outside the law. Among the factors that helped to increase the formalization of the economy, we can mention the increase in the credit market and the expansion of the average schooling of Brazilians.

In addition, measures to simplify legal standards help to reduce the cost of formalization, stimulating a reduction in the shadow economy. In this sense, measures with the implementation of electronic invoices (NFes), SIMPLES and MEI tend to formalize the economy more.

Between the second quarter of 2014 and the fourth quarter of 2016, Brazil faced a long period of recession (11 quarters) according to the Economic Cycle Dating Committee (CODACE). One of the consequences of this loss of dynamism in the economy was the increase in the number of people engaged in informal activities.

We can see (Graph) a worsening in the Shadow Economy Index between the years 2015 and 2019. In this period, there was an increase of more than 1 percentage point in the Shadow Economy Index, so that it went from 16,2% in 2015 to 17,3% in 2019.

Between 2016 and 2019, there was a recovery of employment, albeit informal, whose work relations are much more flexible, generating increases in the number of people without a formal contract and in the share of this group's income in the total income.

Therefore, the increase in informality observed in this period made the impact via the labor market greater, thus leading to successive increases in the Underground Economy Index between the years 2015 and 2019.

In 2022, it was possible to notice an increase of 0,4 percentage points in the indicator, explained by the return to the pattern of elevations observed before the pandemic. This value observed in 2022 shows that the shadow economy in Brazil moved something close to R$ 1,7 trillion reais, close, for example, to Sweden's GDP, which corresponds to something close to 18% of Brazilian GDP, according to data from the IMF.

This increase in the indicator in 2022 is associated with the beginning of economic normalization and the change in the composition of the labor market. With the pandemic under control, there was a faster recovery in the informal sector compared to the decline observed in formal workers, which led to an increase in informality.

The positive side is that the structural factors that led to the reduction of shadow economy remain present in the Brazilian economy. The process of simplifying norms and regulations remains active (with prospects of expansion by the current government), the average Brazilian education continues to increase and the credit market should return to its growth trajectory.

In addition, the effects of the labor reform tend to stimulate the formalization of the labor market, reducing the relative cost of formalization, stimulating the return of formal employment. The recent creation of the PIX should also strengthen, in the coming years, the use of formal payment mechanisms, facilitating the measurement of economic activities and, therefore, allowing the reduction of the informal share in the Brazilian GDP in the long term.