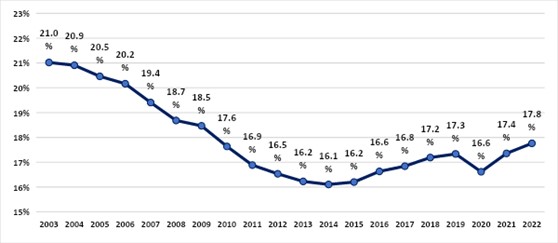

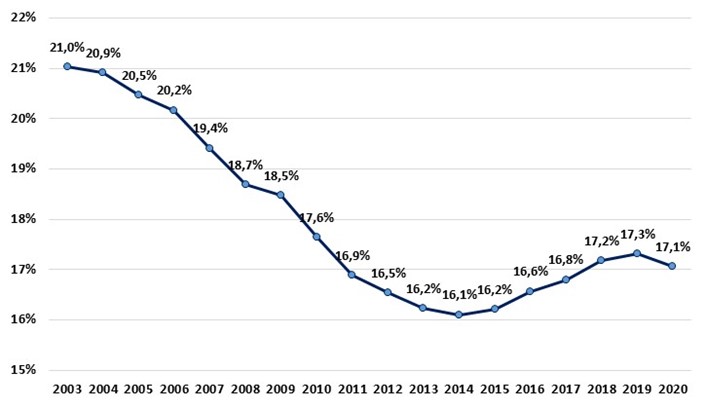

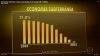

The shadow economy's share in the Brazilian economy reached around 17,8% of GDP in 2022, as shown by the Underground Economy Index (IES). This result is higher than that observed in 2021 (17,4%) and points to a return to the pattern of elevations observed in the pre-pandemic period. The index built in a partnership between the Brazilian Institute of Ethics and Competition, ETCO, and FGV IBRE measures the evolution of the underground economy since 2003 and seeks to capture the evolution of activities that operate outside the laws and regulations that affect formal activities in the country .

The increases observed in the indicator up to 2019 were a consequence of the crisis that began in mid-2014, which reduced the formal sector of the economy, and the slow recovery of economic activity, concentrated in its most flexible part, the informal economy, which was pulling the employment in the country. At the same time, the reduction in interest rates and the slow increase in income softened the shadow economy's growth scenario, which would be stronger in the absence of these factors.

However, the events of recent years associated with the Covid-19 pandemic increased the level of uncertainty in relation to the performance of the economy in an extraordinary way. The negative impacts on economic activity and on the labor market affected informal workers more intensely, compared to formal workers. This change in the composition of the labor market, with a greater weight of formalization, combined with the sharp reduction in the level of economic activity, contributed to the decline in the Underground Economy Index (IES) in 2020.

After the most acute phase of the pandemic, the process of normalization of economic activity began, stimulating both the formal and informal economy, recording a return of informality to the standards observed in the pre-pandemic period, partly caused by the faster recovery of informal employment , which was to be expected given the greater flexibility in this type of bond, thus, the Underground Economy Index (IES), since 2021, has grown again, reversing the drop observed in 2020.

In the last two years, the return of economic activity has meant that both the formal and informal economy have seen a strong recovery. However, the informal part of the labor market showed stronger recovery in relative terms, causing the IES to present growth in the period, more than offsetting the drop that occurred in the pandemic.

In order to understand this topic in more depth, ETCO (Brazilian Institute of Ethics in Competition) and IBRE/FGV have developed a index for monitoring shadow economy providing an indicator of the evolution of informal activities. Shadow economy is defined as the production of goods and services not reported to the government, deliberately, to: evade taxes; evading social security contributions; circumvent compliance with labor laws and regulations; avoid costs arising from the rules applicable to each activity.

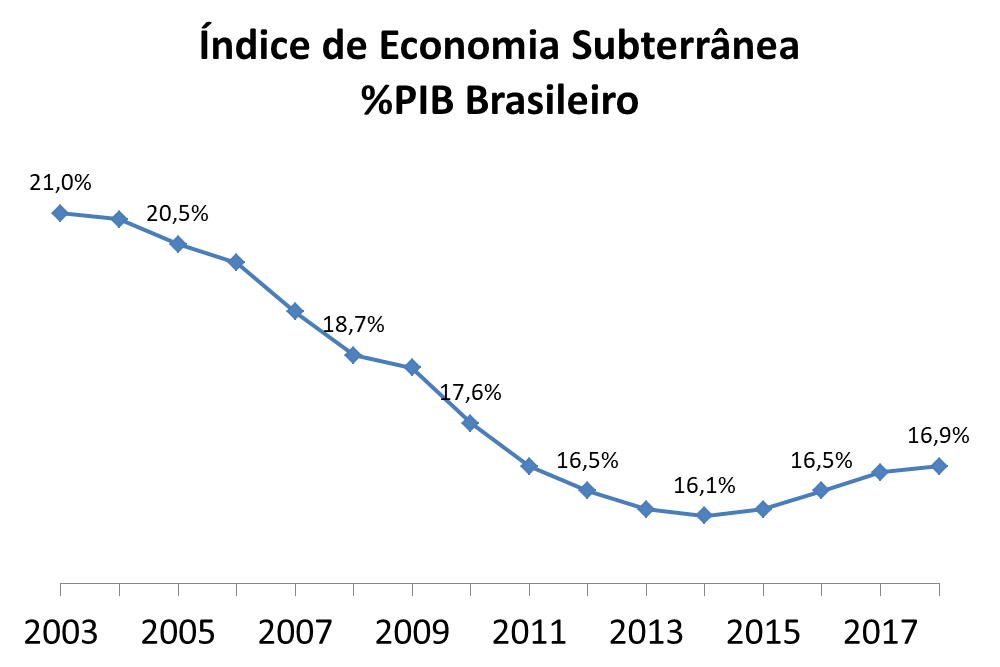

The index starts in 2003, with the highest value of the historical series, around 21% of the Brazilian GDP. Between 2003 and 2014, in the period of strong expansion of formal employment, the Underground Economy Index showed a strong downward trend, reaching its lowest value in 2014 (16,1%). Since then, as a result of the 2015/2016 crisis, the index has shown an upward trend, interrupted by the COVID 19 crisis. The normalization of economic activity signals a further increase in the index.

Several structural factors stimulate the formalization of the labor market: an increase in the average level of schooling among Brazilians; simplification measures of legal rules that reduce the cost of formalization, such as the implementation of electronic invoices (NFes), SIMPLES, MEIA and the expansion of the credit market reduced the shadow economy in the country in the 2000s, expanding economic activities in accordance with the law.

It is a fact that the economic situation has a strong impact on the underground economy. The 2015/2016 crisis led to the growth of informal employment, stimulating successive increases in the Underground Economy Index between 2015 and 2019.

The advance of the Covid-19 pandemic generated a strong reduction in the space for informal workers, causing the index to decline in 2020, with the change in the composition of the labor market, with a greater weight of formalization, combined with a strong reduction in the level of economic activity .

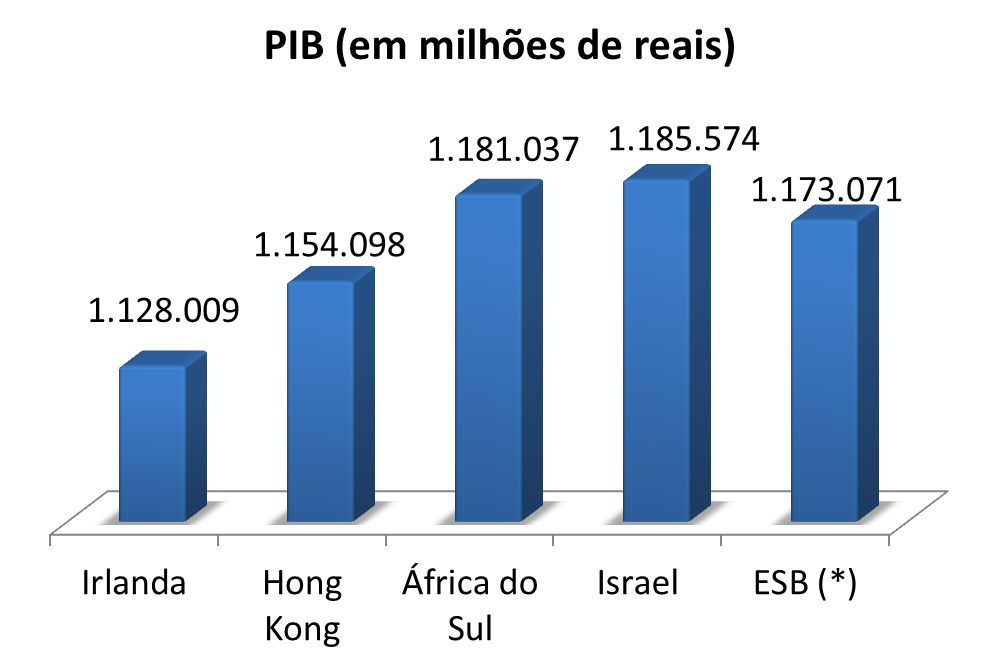

Since 2021, due to the beginning of economic normalization and the faster recovery of the informal sector, we have noticed an increase in the Underground Economy Index, indicating a return to the pattern of increases observed before the pandemic. In particular, in the year 2022, the weight of shadow economy in GDP was 17,8%. This value observed in 2022 shows that the shadow economy in Brazil moved something close to R$ 1,7 trillion reais, close for example to Sweden's GDP, which correspond to something close to 18% of Brazilian GDP, according to IMF data. .

Due to lower costs, the recovery of the labor market was encouraged by informal employment, with the possibility of a further increase in the shadow economy indicator in the coming years. Therefore, the decrease in the index will depend on the speed of recovery of the economy and the progress of the necessary reforms to stimulate the economy.

The good news is that the structural factors that led to the reduction of shadow economy remain present in the Brazilian economy. In particular, the process of simplifying norms and regulations remains active (with prospects of expansion by the current government), the average Brazilian education continues to increase and the credit market should return to its growth trajectory. In addition, the effects of the labor reform should continue to stimulate the formalization of the labor market, reducing its cost. On the other hand, the creation of the PIX should strengthen, in the coming years, the use of formal payment mechanisms, facilitating the measurement of economic activities and, therefore, in the long term, allowing the reduction of the informal share in the Brazilian GDP.

* Edson Luiz Vismona (president of ETCO – Brazilian Institute of Ethics in Competition) and Fernando de Holanda Barbosa Filho – economist at FGV/IBRE