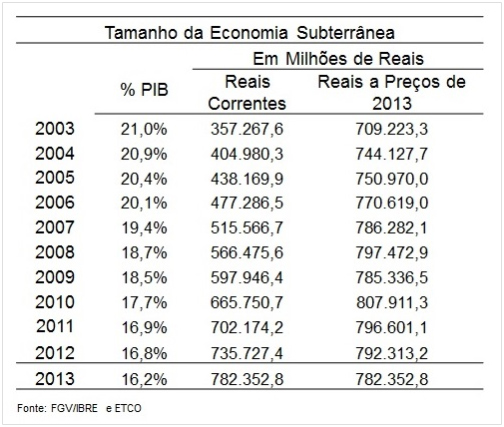

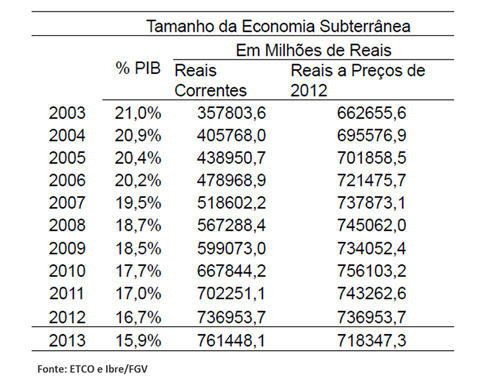

Disclosed on November 12, the share of the underground economy in GDP, measured by the ETCO's Underground Economy Index (IES) in conjunction with the Brazilian Institute of Economics of the Getúlio Vargas Foundation (FGV / IBRE), should reach 16,2% in 2014. The result represents a decrease of 0,1 percentage point in comparison with 2013 and indicates a tendency towards a slower pace in reducing informality.

Disclosed on November 12, the share of the underground economy in GDP, measured by the ETCO's Underground Economy Index (IES) in conjunction with the Brazilian Institute of Economics of the Getúlio Vargas Foundation (FGV / IBRE), should reach 16,2% in 2014. The result represents a decrease of 0,1 percentage point in comparison with 2013 and indicates a tendency towards a slower pace in reducing informality.

In absolute values, the estimate is that the underground economy - the production of goods and services not reported to the government, which is outside the national GDP - exceeds the R $ 830 billion mark in 2014.

In the evaluation of FGV / IBRE researcher, Fernando de Holanda Barbosa Filho, the result was directly impacted by the low growth of the economy in the year. “The economy is slowing down, as well as credit, and employment has grown little. This has a direct impact on formal work, which naturally falls, giving way to informality ”, he explains. According to him, not even the tax exemption policy applied in 2013, which now becomes definitive, was sufficient to face the low economic performance and maintain the downward pace of the underground economy. "However, were it not for the exemptions, we could have an even more severe picture", analyzes the researcher.

For him, even the implementation of MP 615/13, which extends exemptions for new activities, should not change the scenario much from now on, “because the relief of the tax burden has already reached most sectors and its effects have already been captured” .

For ETCO's Executive President, Evandro Guimarães, “there is no denying the importance of exemptions for the economy as a whole, but, as far as we can see, their effectiveness with regard to formalization, tends to stabilize”. According to him, these measures should be analyzed from a more lasting perspective. "It is the moment to carry out the long-awaited tax simplification, so that the tax relief reaches more broadly the productive sectors of the economy".

What is certain is that informality brings direct losses to society, creates an environment of transgression, stimulates opportunistic economic behavior, with a drop in the quality of investment and a reduction in the growth potential of the Brazilian economy. In addition, it causes a reduction in government resources for social programs and investments in infrastructure.