Causes and solutions to the litigation problem

Names of the Executive, Legislative, Judiciary, private sector and academia say what needs to be done to reduce litigation and increase the legal security of our tax system

Why is the relationship between tax authorities and taxpayers so contentious in Brazil? How to solve or at least reduce the legal uncertainty of our tax system? To answer these questions, we interviewed dozens of names representing different institutions involved in this problem.

Directors of the National Confederation of Industry (CNI) and of the Federation of Industries of the State of São Paulo (Fiesp) and tax representatives of some of the main law firms in the country addressed the issue from the point of view of taxpayers.

Representatives of the Ministry of Economy and the Attorney General of the National Treasury (PGFN) brought the vision of the State, either in its role of collecting taxes, or in the mission of strengthening the business environment of the country.

The Judiciary's perspective was presented by judges specialized in Tax Law from three instances of Federal Justice. That of the Legislative, by the rapporteur of the bill that converted the Provisional Measure of the Legal Taxpayer into law, which regulated the solution of conflicts between the Tax Authorities and taxpayers through the so-called tax transaction.

To complete the picture, we also interviewed researchers and university professors, as well as representatives of civil society institutions that deal with the topic.

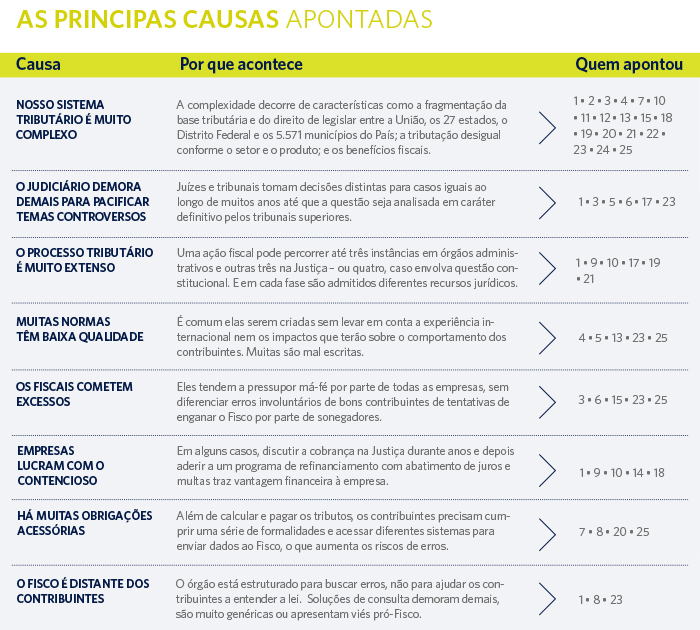

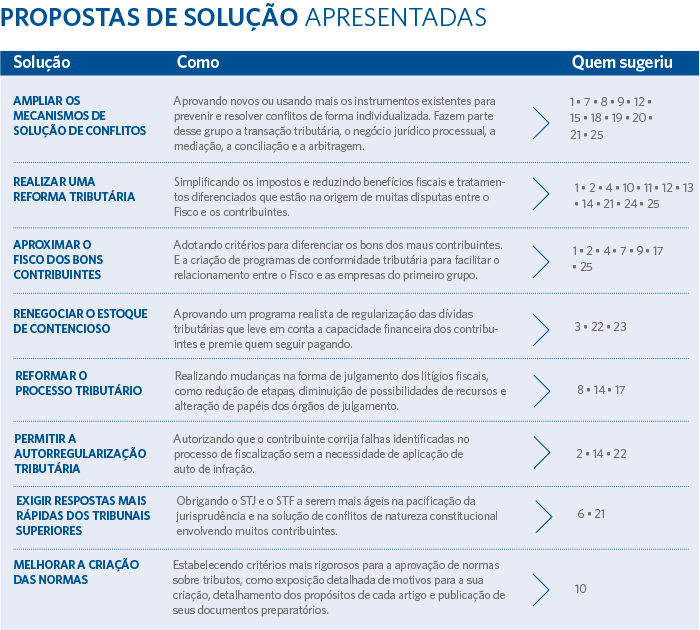

This set of points of view shows that the problem has other causes besides the complexity of our tax system. It also indicates that the solution requires a series of changes in the way we create tax rules, inspect their application and judge litigation.

The table below shows a summary of the main causes pointed out and proposed solutions presented by the interviewees. Next, check out who the interviewees were.

Who are the interviewees

1. Adriana Gomes de Paula Rocha, Deputy Attorney General of Consultancy

and Judicial Representation Strategy.

2. Adriana Gomes Rego, president of the Administrative Council of Appeals

(Carf).

3. Beno Suchodolski, partner at Suchodolski Advogados Associados.

4. Breno Vasconcelos, partner at Mannrich e Vasconcelos Advogados, researcher at Insper and professor at FGV.

5. Cassio Borges, legal superintendent of the National Confederation of Industry.

6. Hamilton Dias de Souza, partner at Dias de Souza Advogados Associados.r legal office of the Federation of Industries of the State of São Paulo (Fiesp).

8. Heleno Torres, full professor at the Department of Economic, Financial and Tax Law at the Faculty of Law of USP.

9. Juliana Furtado Costa Araújo, attorney at PGFN and professor at FGV

Right SP.

10. Leonardo de Andrade Rezende Alvim, PGFN attorney, Insper researcher and university professor.

11. Lorreine Messiah, economist with specialization in Tax Law and researcher.

12. Marco Bertaioli, federal deputy (PSD-SP) and rapporteur of the Bill

Conversion Plan of the Legal Taxpayer.

13. Lisbon Landmarks, economist and president of Insper.

14. Mauro Silva, president of the National Association of Tax Auditors of the Federal Revenue of Brazil.

15. Nelson Machado, director of the Center for Tax Citizenship (CCiF).

16. Paulo Conrado, federal judge and professor of Tax Law at FGV Direito SP.

17. Paulo Sergio Domingues, judge of the Federal Regional Court of the 3rd Region.

18. Phelippe Toledo Pires de Oliveira, Deputy Attorney General for Administrative and Tax Litigation.

19. Raquel Novais, partner in the tax area of Machado Meyer Advogados.

20. Regina Helena Costa, minister of the Superior Court of Justice and professor of Tax Law at the Pontifical Catholic University of São Paulo.

21. Rita Dias Nolasco, attorney at PGFN and director of the School of Advocacy-General of the Union in the 3rd Region.

22. Rita Eliza Reis da Costa Bacchieri, counselor representing taxpayers and vice president of Carf.

23. Roberto Quiroga Mosquera, partner at Mattos Filho, Veiga Filho, Marrey Jr and Quiroga Advogados and professor of Tax Law at the University of São Paulo (USP) and at the Law School of Fundação Getulio Vargas (FGV Direito SP).

24. Vanessa Canado, special advisor to the Minister of Economy, Paulo Guedes, on tax reform.

25. Zabetta Macarini Gorissen, executive director of the Group of Applied Tax Studies (Getap).

President of Insper and ex-secretary of Economic Policy, Marcos Lisboa says that following internationally established practices would be the simplest path for Brazil

President of Insper and ex-secretary of Economic Policy, Marcos Lisboa says that following internationally established practices would be the simplest path for Brazil Getap's executive director, Zabetta Macarini Gorissen, says that Brazil has grown accustomed to resorting to litigation instead of acting directly at the source: improving tax legislation

Getap's executive director, Zabetta Macarini Gorissen, says that Brazil has grown accustomed to resorting to litigation instead of acting directly at the source: improving tax legislation Economist Lorreine Messias, author of studies on the subject, says that structural reform is necessary - and recalls that other countries can set good examples of how to do this

Economist Lorreine Messias, author of studies on the subject, says that structural reform is necessary - and recalls that other countries can set good examples of how to do this The president of Unafisco, Mauro Silva, points out the need to expand professional improvement initiatives for the staff of tax auditors of the Federal Revenue

The president of Unafisco, Mauro Silva, points out the need to expand professional improvement initiatives for the staff of tax auditors of the Federal Revenue Attorney Juliana Araújo, PGFN coordinator at TRF-3, says what the three involved in the issue should do to reduce litigation

Attorney Juliana Araújo, PGFN coordinator at TRF-3, says what the three involved in the issue should do to reduce litigation PGFN Attorney Leonardo Alvim defends tax reform and specific measures to increase legal certainty in the tax field

PGFN Attorney Leonardo Alvim defends tax reform and specific measures to increase legal certainty in the tax field Adriana Gomes de Paula Rocha, Deputy Attorney General of Consultancy and Strategy of the Judicial Representation, talks about the reasons for the congestion of tax processes in the Judiciary

Adriana Gomes de Paula Rocha, Deputy Attorney General of Consultancy and Strategy of the Judicial Representation, talks about the reasons for the congestion of tax processes in the Judiciary The ways to reduce litigation, in the view of the Deputy Attorney General for Consulting and Administrative-Tax Litigation, Phelippe Toledo Pires de Oliveira

The ways to reduce litigation, in the view of the Deputy Attorney General for Consulting and Administrative-Tax Litigation, Phelippe Toledo Pires de Oliveira